Trade Analysis and Recommendations for the Euro

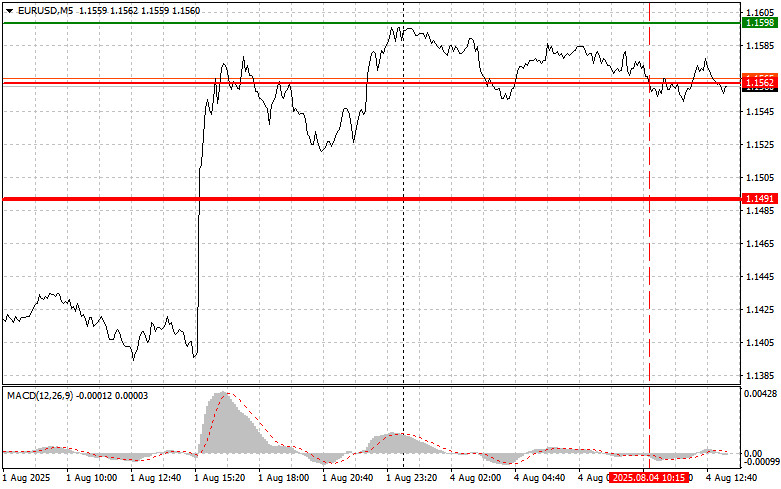

The test of the 1.1562 level occurred when the MACD indicator had already moved well below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro.

Weak data on the Eurozone Sentix Investor Confidence Index, which came in at -3.7 points and below economists' forecasts, put pressure on the euro in the first half of the day. However, contrary to the pessimists' expectations, buyers showed unexpected resilience, successfully offsetting the negative effect of the release and preserving the potential for further growth in EUR/USD. The initial market reaction certainly reflected concerns about slowing economic growth in the region. Nevertheless, the euro's subsequent recovery suggests the presence of deeper fundamental factors supporting the currency. This resilience in the face of negative Sentix data inspires optimism and gives hope for a continuation of the upward trend in the near term.

In the second half of the day, U.S. factory orders data will be released, but even if the figures are strong, they are unlikely to significantly support the dollar. The market will likely show a muted reaction, as short-term macroeconomic data typically have limited impact on exchange rates in the long run. Traders' and investors' main focus remains on speeches by Fed officials and statements from the White House—particularly regarding the future of Federal Reserve monetary policy. In the context of factory orders, even if the numbers significantly exceed forecasts, any positive effect on the dollar is likely to be short-lived.

As for the intraday strategy, I'll primarily rely on the execution of Scenarios #1 and #2.

Buy Signal

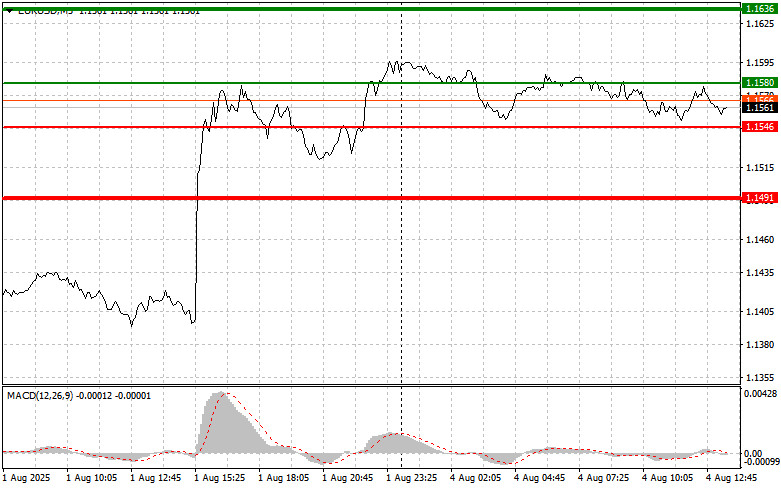

Scenario #1: Buy the euro today upon reaching the 1.1580 level (green line on the chart), targeting a rise to 1.1636. At 1.1636, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point pullback from the entry point. A strong euro rally today will only be likely if U.S. data is very weak. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1546 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Targets will be 1.1580 and 1.1636.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1546 level (red line on the chart). The target is 1.1491, where I plan to exit the market and open a buy position in the opposite direction (targeting a 20–25 point reversal from that level). Selling pressure on the pair will increase if U.S. data is strong. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1580 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. Targets will be 1.1546 and 1.1491.

Chart Notes:

- Thin green line – Entry price to buy the trading instrument

- Thick green line – Estimated Take Profit level or a point to manually fix profit, as further growth beyond this level is unlikely

- Thin red line – Entry price to sell the trading instrument

- Thick red line – Estimated Take Profit level or a point to manually fix profit, as further decline below this level is unlikely

- MACD Indicator – Use overbought and oversold zones to guide entry decisions

Important: Beginner Forex traders must be extremely cautious when making entry decisions. Before the release of major fundamental reports, it's best to stay out of the market to avoid sharp price fluctuations. If you do decide to trade during news events, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't apply money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decision-making based on the current market situation is a losing strategy for any intraday trader.