Trade Review and Tips for Trading the Euro

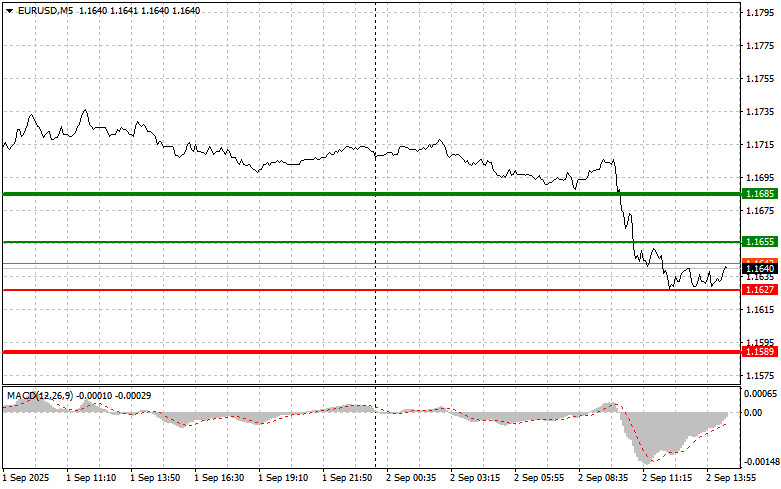

The price test at 1.1684 occurred when the MACD indicator had just begun moving downward from the zero mark, confirming the correct entry point for selling the euro. As a result, the pair fell by 40 points.

The euro's decline began well before the publication of data showing higher inflation in the eurozone in August. Apparently, large market participants already had information or expectations. Statements by European Central Bank (ECB) officials about keeping interest rates unchanged put additional pressure on the euro. Traders interpreted the lack of new signals about monetary tightening as a sign of ECB concerns over eurozone growth prospects, which weakened the euro's position.

In the second half of the day, the market expects the release of data on manufacturing activity, the ISM Manufacturing Index, and U.S. construction investment figures. An increase in the manufacturing activity index indicates expanding production, rising orders, and an overall improvement in business conditions. Meanwhile, growth in the ISM Manufacturing Index, considered a leading indicator, signals potential employment gains and stronger industrial investment. Traders will closely analyze these figures to assess the stability of the U.S. economy, which could support the dollar later in the day. The overall picture of these indicators will be especially important, since simultaneous growth in business activity, the ISM index, and construction investment would clearly point to a strong and resilient U.S. economy.

As for intraday strategy, I will focus on implementing scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible at around 1.1655 (green line on the chart), targeting 1.1685. At 1.1685, I plan to exit and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong rise in the euro is unlikely today. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of 1.1627, at the moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 1.1655 and 1.1685.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches 1.1627 (red line on the chart). The target will be 1.1589, where I plan to exit and immediately buy in the opposite direction, aiming for a 20–25 point move from that level. Selling pressure on the pair may return at any time today. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of 1.1655, at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.1627 and 1.1589.

What is on the chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – indicative price for placing Take Profit or manually fixing profits, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – indicative price for placing Take Profit or manually fixing profits, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner traders in the Forex market should be very cautious when making entry decisions. Before important fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous decisions based on current market conditions are an inherently losing strategy for intraday traders.