Trade Analysis and Tips for Trading the Euro

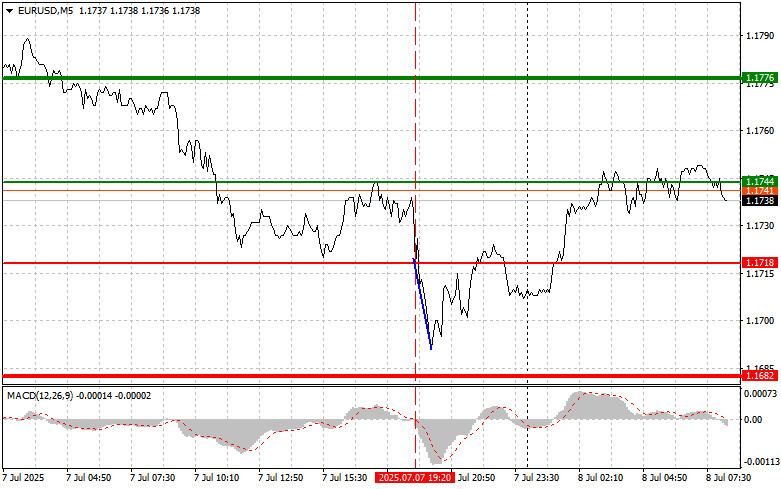

The test of the 1.1718 level occurred when the MACD indicator had just started to move downward from the zero mark, which confirmed a valid entry point for selling the euro and resulted in a decline of more than 30 points.

The news released yesterday about Trump's decision to postpone the introduction of new tariffs from July 9 to August 1 supported demand for risk assets, which limited the downward potential of the EUR/USD pair. Although temporary, this delay reduced concerns about an imminent escalation of the trade conflict between the U.S. and Europe. Trump's decision had a noticeable impact on the currency markets, leading to a weakening of the dollar against most major currencies. The euro showed particular resilience, strengthening after a period of instability caused by fears over the pace of economic growth in the euro area. Traders will continue to monitor developments and the outcomes of further negotiations to assess the prospects for a long-term resolution.

Today will bring data on the trade balance of Germany and France, as well as a speech by Bundesbank President Joachim Nagel. It is unlikely that these events will significantly change the market situation, but they will contribute to shaping the broader economic landscape, which is important for making investment decisions. The trade balance, in particular, is a key indicator of a country's competitiveness. An increase in the surplus usually signals a rise in export potential and positively affects the national currency. However, in today's unstable global economy, even solid trade performance—especially in the context of imposed tariffs—can be offset by other factors such as geopolitical risks or changes in monetary policy.

Nagel's speech is important from the perspective of the European Central Bank's future monetary policy. Market participants will closely analyze his remarks to assess the likelihood of further interest rate hikes and the overall stance of the regulator on inflation. Any indications of a more cautious approach following a series of rate cuts may support the euro, while signals of potential further easing could put pressure on the European currency.

As for intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Scenarios

Scenario #1: Today I plan to buy the euro upon reaching the 1.1751 level (green line on the chart), targeting a rise to 1.1786. At 1.1786, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30–35 points from the entry point. A bullish outlook for the euro today depends on strong economic data. Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1732 level at a time when the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a reversal to the upside. A rise toward 1.1751 and 1.1786 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the euro after it reaches the 1.1732 level (red line on the chart), with a target at 1.1703, where I intend to exit the market and buy immediately in the opposite direction, aiming for a 20–25 point retracement. Selling pressure on the pair could return today if the data is weak. Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1751 level when the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a downward reversal. A decline toward 1.1732 and 1.1703 can be expected.

Chart Notes:

- The thin green line represents the entry price for buying the instrument.

- The thick green line indicates the approximate level for placing Take Profit orders or manually closing a trade, as further growth beyond this point is unlikely.

- The thin red line represents the entry price for selling the instrument.

- The thick red line indicates the approximate level for placing Take Profit orders or manually closing a trade, as further decline beyond this point is unlikely.

- MACD Indicator: When entering the market, it is important to refer to overbought and oversold zones.

Important: Beginner Forex traders should be very cautious when deciding to enter the market. Before the release of significant fundamental data, it is best to remain out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not apply money management and trade with large volumes.

And remember, successful trading requires a clear trading plan—such as the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.