The GBP/USD currency pair also showed a relatively strong rise and high volatility on Friday, but at the same time failed to consolidate above the moving average line. We believe the trend is once again turning north, but it's still better to wait for technical confirmations of this hypothesis—although, formally, they already exist. Over the past week, we've been constantly referring to the Senkou Span B line on the daily time frame, and on Friday, the price made a perfect rebound from this line. Thus, there is every reason to assume the correction is over.

Let's take a look at the situation from the perspective of fundamentals and macroeconomics. What arguments are there for the dollar to continue growing? A strong GDP? It plays no role after Friday's labor market, unemployment, and manufacturing business activity data. And we haven't even seen the services sector business activity data yet. Inflation is rising, unemployment is rising, business activity is falling, job creation is virtually nonexistent, imports are declining, the purchasing power of Americans is falling, and Donald Trump is cutting all social and healthcare programs for low-income groups. But GDP grew by 3%.

Therefore, we wouldn't bet a penny on the growth of the U.S. dollar right now. The Federal Reserve's monetary policy outlook deserves separate attention. Throughout 2025, we've been saying that the U.S. central bank might not lower the key rate even once, due to the high risks of rising inflation. We repeatedly cited Jerome Powell, who regularly emphasized inflation risks in the new trade reality. However, the Fed Chair also frequently mentioned the possibility of easing if the labor market showed signs of serious slowdown, since the Fed's second mandate is to ensure full employment. And when choosing between putting people to work and controlling inflation, the first option should probably take precedence.

The Fed may lower rates as soon as the next meeting, and now we're much more inclined to believe that the central bank will continue cutting rates at every meeting through the end of the year. We may even see a 0.5% cut at one of them. At this point, the market's and analysts' dovish expectations are entirely reasonable and justified. And what does this mean for the dollar, which was collapsing through most of 2025 while only the European Central Bank and Bank of England were cutting rates? It means that now it may fall even faster and more decisively. Of course, this is just a forecast—but forecasts and money-making strategies are built on such assumptions.

On Tuesday, the U.S. will release its second ISM business activity report—this time for the services sector. If that data also disappoints, the outlook for the dollar will deteriorate further. On Thursday, the BoE will hold its policy meeting, at which it plans to lower the rate by 0.25%—for the third time this year. This may be the very factor currently holding back the pound from stronger growth. Meanwhile, the ECB has nearly completed its easing cycle, so from here on out, the market will likely be focused only on Fed easing.

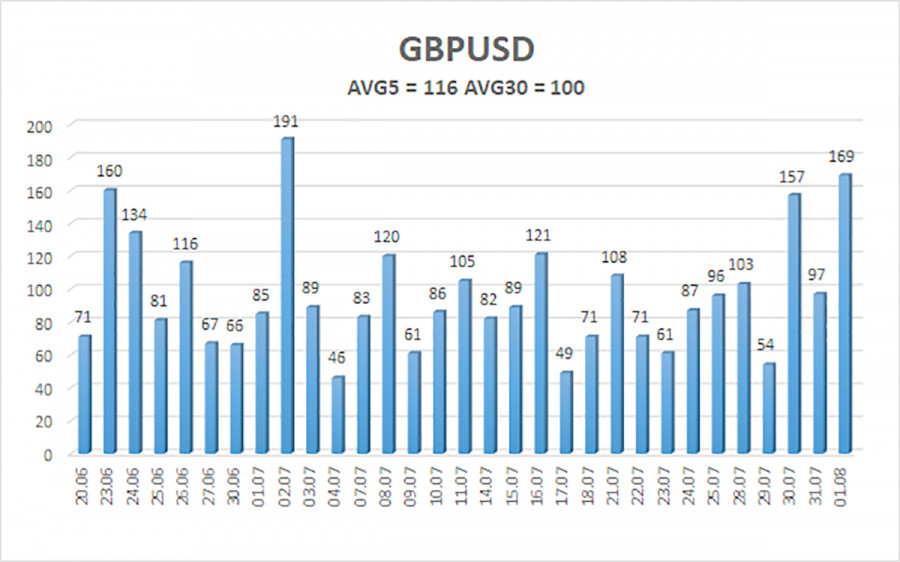

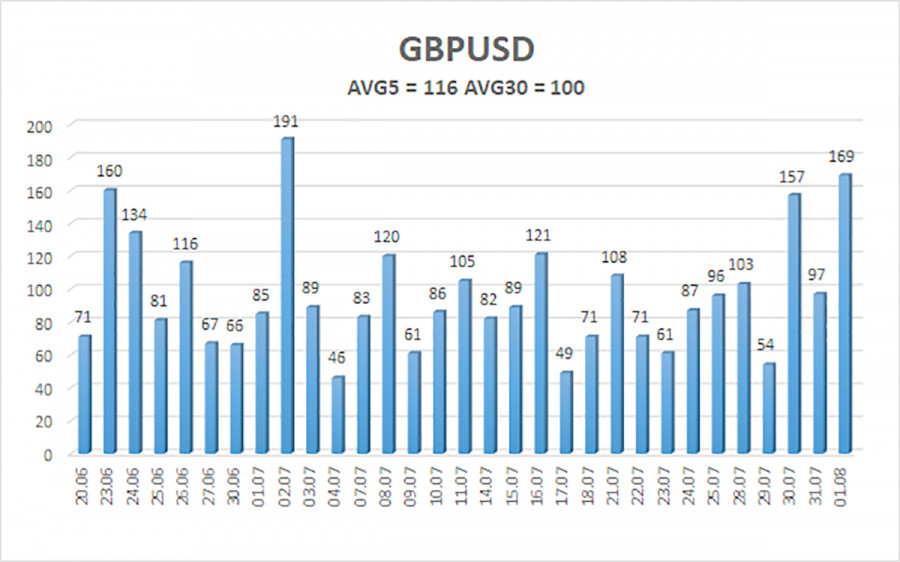

The average volatility for GBP/USD over the last five trading days is 116 pips. For this currency pair, that is considered "high." On Monday, August 4, we expect movement within a range limited by the levels of 1.3162 and 1.3394. The long-term linear regression channel is pointing upward, indicating a clear upward trend. The CCI indicator has entered the oversold zone twice, signaling a potential resumption of the upward trend. A new corrective wave is currently underway.

Nearest Support Levels:

S1 – 1.3245

S2 – 1.3184

S3 – 1.3123

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3367

R3 – 1.3428

Trading Recommendations:

The GBP/USD pair continues a downward correction for now. In the medium term, Trump's policies will likely continue to pressure the U.S. dollar. Therefore, long positions targeting 1.3550 and 1.3611 remain more relevant if the price is above the moving average. If the price is below the moving average line, small short positions targeting 1.3184 and 1.3162 can be considered based purely on technical grounds. From time to time, the U.S. currency shows corrective rebounds, but for a sustained uptrend, tangible signs of an end to the global trade war are needed—and that now seems unlikely.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.