Analysis of Trades and Trading Tips for the Euro

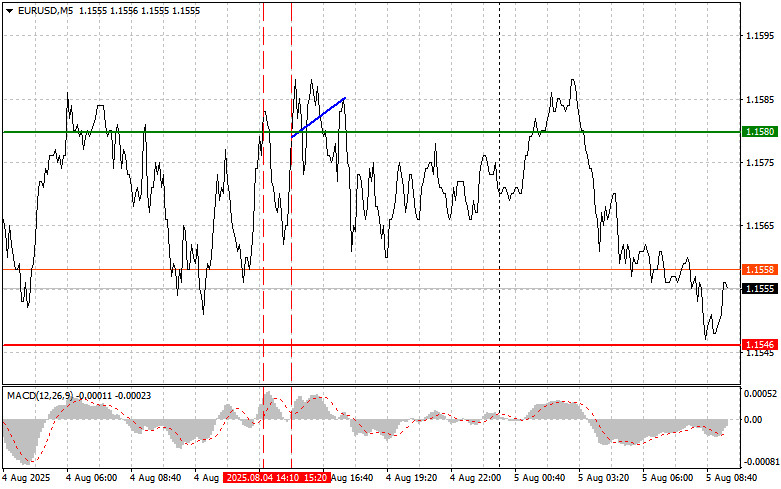

The price test at 1.1580 occurred at the moment when the MACD indicator was just beginning to move up from the zero level, confirming a valid entry point for buying the euro. However, as you can see on the chart, the pair failed to deliver a significant upward move.

The euro weakened amid disappointing data from the eurozone, but later recovered its losses against the U.S. dollar following the release of similarly weak data on declining factory orders in the U.S. Nevertheless, despite the temporary dip, the euro maintained its recovery potential, indicating continued confidence in the European economy. In the near future, the direction of the currency pair will depend on a range of factors, including key macroeconomic reports.

Today, market participants expect the release of the eurozone services PMI and the composite PMI. Attention will also be drawn to the eurozone Producer Price Index (PPI) for June. Markets are on edge awaiting these key indicators, which may shed light on the current state of the European economy. Any deviation from forecasted values could spark sharp volatility in the forex market, especially in EUR/USD. The services PMI, being a leading indicator, provides insight into business activity in a sector that plays a major role in the eurozone economy. The composite PMI, which combines data from both manufacturing and services, will offer a more complete picture of the region's overall economic health.

PPI data for June is especially important in the context of inflation. A rise in the PPI may signal a return of inflationary pressures, which in turn could push the European Central Bank to pause further rate cuts. However, it's important to note that the market's reaction will depend not just on the data itself, but also on how it compares to economists' expectations.

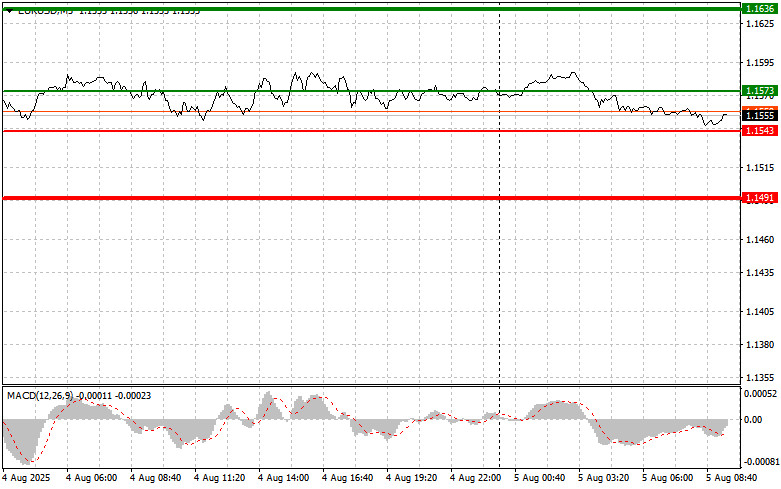

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Buy the euro today when the price reaches the area around 1.1573 (green line on the chart) with a target of rising to 1.1636. I plan to exit the market at 1.1636 and open a sell position in the opposite direction, expecting a move of 30–35 pips from the entry point. A bullish move in the euro is likely only if the data is strong.

Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1543 level while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise toward 1.1573 and 1.1636 can then be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches the 1.1543 level (red line on the chart). The target will be 1.1491, where I plan to exit and buy immediately in the opposite direction (expecting a 20–25 pip bounce from the level). Downward pressure on the pair is unlikely to return today.

Important! Before selling, ensure the MACD indicator is below the zero mark and starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1573 level while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a downward reversal. A decline toward 1.1543 and 1.1491 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.