Analysis of Macroeconomic Reports:

Several macroeconomic reports are scheduled for release on Thursday, but they will all be similar in nature. Business activity indices for the services and manufacturing sectors for July will be released in Germany, the United Kingdom, the Eurozone, and the United States. It is worth noting immediately that any index exhibiting a significant deviation from the forecast can prompt a market reaction. However, these indices are not considered highly important for traders — especially under current circumstances, where the U.S. dollar has been falling for six consecutive months regardless of central bank monetary policies or local macroeconomic reports.

Analysis of Fundamental Events:

Among Thursday's fundamental events, the European Central Bank meeting is undoubtedly the key highlight. However, first, the ECB is not expected to make any important decisions today. Second, the euro has been rising steadily even as the ECB has continuously cut its key rate. In other words, there is currently no correlation between the ECB's monetary policy and the euro exchange rate. As such, the market may react locally even if the ECB announces no decisions — but that reaction is unlikely to affect overall market sentiment, which has remained bullish for half a year.

The trade war remains the top concern for the market, and we still see no signs of it coming to an end. This topic is likely to remain a key driver for the dollar for quite some time. So, don't be surprised if we repeat the same message every day. The situation remains difficult, as Trump has managed to sign just three trade deals over more than four months of negotiations — and one of those is somewhat questionable—three deals out of a possible seventy-five.

Over the past two weeks, the U.S. president has decided to raise tariffs once again for countries that are not rushing to make agreements with Washington, while also increasing import duties on copper, pharmaceuticals, and semiconductors. The market has yet to fully absorb the effects of these new tariffs, as it has been preoccupied with a technical correction.

Conclusions:

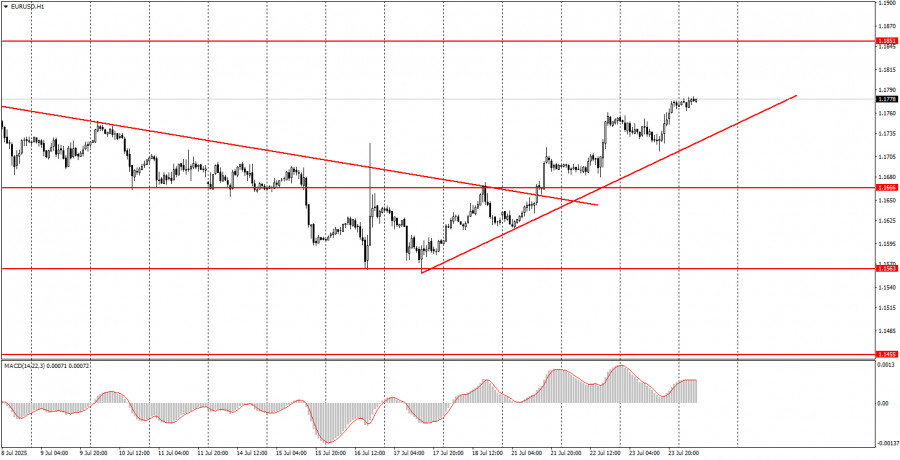

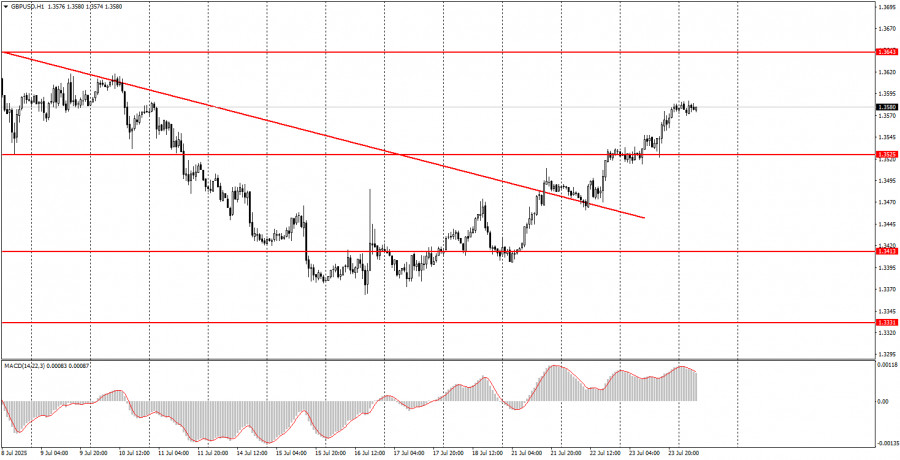

During the penultimate trading day of the week, both currency pairs may continue their upward movement. Technical corrections are now complete, so we expect growth to continue over the coming weeks and months. For the euro, the 1.1740–1.1745 zone was crucial and has been broken. For the pound sterling, the key area is 1.3574–1.3590.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.