Analysis of Trades and Trading Tips for the British Pound

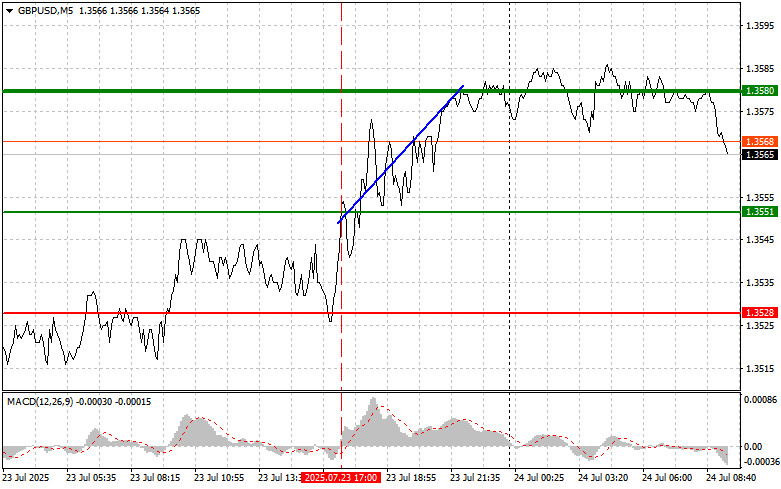

The test of the 1.3551 level occurred when the MACD indicator had just started moving up from the zero line, confirming the validity of the entry point for a long position on the pound. As a result, the pair rose by 30 points.

Today, important data is expected regarding the UK Manufacturing PMI, Services PMI, and Composite PMI. The PMI is a key barometer of the state of the British economy, reflecting sentiment in the manufacturing and services sectors. The Composite PMI, which combines data from both sectors, provides a general picture of the country's economic activity. Market expectations are focused on a possible increase in these indicators. Positive results may indicate strengthening in the British economy, which in turn would enhance the appeal of the British pound for investors. Increased demand for the pound, driven by positive economic sentiment, would support its appreciation against other currencies.

At the same time, it's important to remember that the impact of economic data on the exchange rate can be short-lived. The market reaction depends not only on the absolute PMI values but also on how closely the data align with forecasts. If the actual figures exceed expectations, the effect on the pound will be more pronounced.

In the short term, PMI reports could be a key driver of exchange rate fluctuations; however, sustainable pound growth will require broader, positive economic trends.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

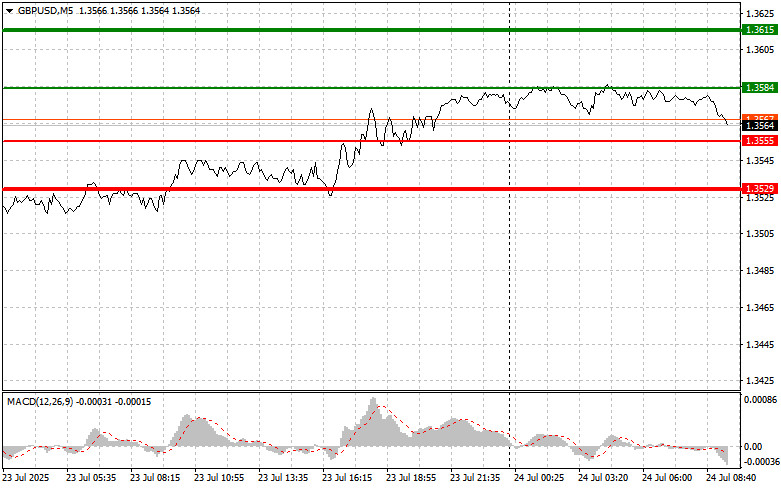

Scenario #1: I plan to buy the pound today around the 1.3584 level (green line on the chart), targeting growth toward 1.3615 (thicker green line). Around 1.3615, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 point pullback from the level). Pound strength today would align with the ongoing upward trend.

Important: Before buying, ensure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3555 level while the MACD is in oversold territory. This would limit the pair's downside potential and lead to a market reversal upward. A rise toward the opposite levels of 1.3584 and 1.3615 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound after it breaks below 1.3555 (red line on the chart), which should result in a quick decline. The key target for sellers will be 1.3529, where I plan to exit short positions and open long positions in the opposite direction (expecting a 20–25 point rebound from the level). Selling the pound today is justified if the PMI data disappoints.

Important: Before selling, ensure the MACD indicator is below the zero line and is just starting to decline.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3584 level while the MACD is in the overbought area. This would limit the pair's upside potential and trigger a downward reversal. A drop toward the opposite levels of 1.3555 and 1.3529 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.