Analysis of Trades and Trading Tips for the Euro

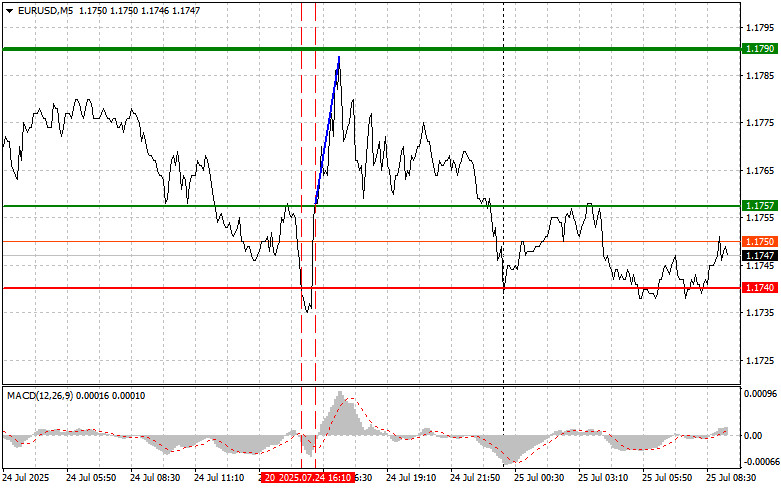

The test of the 1.1757 level occurred at the moment when the MACD indicator had just started to rise from the zero line, confirming a valid entry point for buying the euro. As a result, the pair rose by 30 pips.

Following yesterday's European Central Bank meeting, President Christine Lagarde announced that interest rates would remain unchanged, signaling a wait-and-see approach. This supported the euro, although the rise was more modest than expected. Market participants had anticipated clearer signals from the ECB regarding future steps. Lagarde acknowledged issues related to trade policy and the strong euro, but provided no clear guidance on the future policy path. Such caution disappointed some investors who had hoped for more proactive steps toward monetary easing. In the coming weeks, a key factor shaping ECB policy and euro dynamics will be close monitoring of eurozone macroeconomic data, including progress toward a trade agreement between the EU and the U.S.

This morning could provide upward momentum for EUR/USD, driven by positive data from Germany. The focus will be on IFO business climate indices, which reflect current conditions and future expectations. A report on private sector lending activity in the eurozone will also be released. If the IFO index shows improvement—particularly alongside better current assessments and forecasts—it could significantly support the euro. Market participants tend to interpret such figures as confirmation of the strength and stability of the German economy, which would have a positive impact on the euro. Favorable lending data would further boost optimism, signaling increased investment and consumer activity. At the same time, potential risks should not be ignored. If the published data disappoints, a wave of euro selling is possible. The market is closely watching for any signs of weakness in the German economy, and weak IFO figures could cast doubt on the eurozone's broader outlook.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

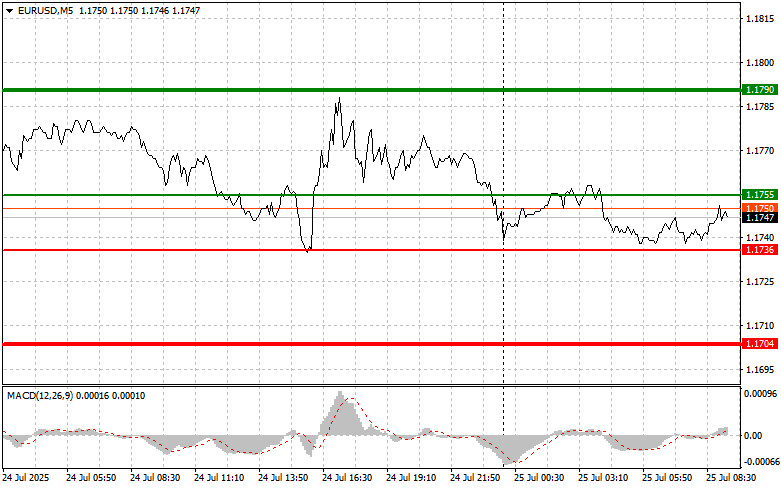

Scenario #1: Buy the euro today on a move toward the 1.1755 level (green line on the chart), targeting a rise to 1.1790. At 1.1790, I plan to exit the market and open a short position in the opposite direction, expecting a 30–35 pip pullback from the entry point. A rally in the euro can only be anticipated following the release of strong data from Germany.

Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise.

Scenario #2: I also plan to buy the euro today if 1.1736 is tested twice in a row while the MACD is in oversold territory. This would limit the pair's downside potential and prompt a reversal to the upside. A rise toward 1.1755 and 1.1790 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro once it reaches the 1.1736 level (indicated by the red line on the chart). The target will be 1.1704, where I intend to exit and open a long position in the opposite direction (expecting a 20–25 pip bounce from the level). The downward pressure on the pair will return only in response to weak data.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline.

Scenario #2: I also plan to sell the euro today if the 1.1755 level is tested twice in a row while the MACD is in overbought territory. This would cap the pair's upside potential and lead to a downward market reversal. A decline toward 1.1736 and 1.1704 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.