Trade Analysis and Recommendations on the European Currency

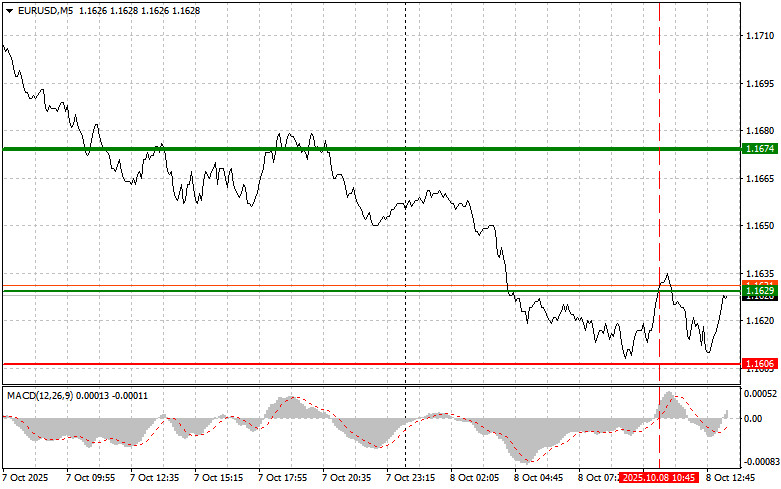

The price test of 1.1629 occurred at a moment when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

A significant decline in German industrial production in August, amounting to 4.3%, triggered a drop in the euro exchange rate at the start of the trading day. Investors, worried about this data pointing to a potential recession in Europe's leading economy, immediately reacted by selling the euro against the U.S. dollar. The decrease in Germany's production output is not just a temporary phenomenon but a serious cause for concern. Germany, as a key driver of European industry, strongly influences the regional economic climate. Moreover, the published figures indicate a fall in manufacturing orders, reflecting business doubts about growth prospects. Companies are cutting investments and operating expenses, fearing a worsening of economic conditions. All this negatively affects the euro exchange rate.

In the second half of the day, several interviews and public speeches from Federal Reserve representatives are scheduled. Special attention should be paid to the speeches of FOMC members Michael S. Barr, Neel Kashkari, and Austan D. Goolsbee. The market will closely watch their comments regarding inflation and the future direction of monetary policy. Investors will carefully analyze the Fed speakers' rhetoric, looking for the slightest hints of policy adjustment toward further easing. On one hand, persistent inflation dictates the need to maintain a wait-and-see approach, keeping interest rates unchanged. On the other hand, slowing economic growth and the U.S. government shutdown may force the regulator to shift toward a more dovish stance.

It is also crucial for traders to thoroughly analyze the September FOMC meeting minutes. This document will provide insight into how the Fed decided to cut interest rates in September and what factors they relied upon.

As for intraday strategy, I will rely more on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro when the price reaches around 1.1636 (green line on the chart) with the goal of rising to 1.1674. At 1.1674, I plan to exit the market and also sell the euro in the opposite direction, targeting a 30–35 point move from the entry point. A euro rise today will be possible only after weak U.S. data. Important! Before buying, make sure the MACD indicator is above zero and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of 1.1608, at the moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected to the opposite levels of 1.1636 and 1.1674.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches 1.1608 (red line on the chart). The target will be 1.1564, where I will exit the market and immediately buy in the opposite direction (aiming for a 20–25 point move in the opposite direction). Pressure on the pair may return at any moment today. Important! Before selling, make sure the MACD indicator is below zero and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of 1.1636, at the moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline can be expected to the opposite levels of 1.1608 and 1.1564.

Chart Notes

- Thin green line – entry price for buying the instrument.

- Thick green line – expected price where Take Profit can be set, or where profits can be manually fixed, since further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – expected price where Take Profit can be set, or where profits can be manually fixed, since further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders must be extremely cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, such as the one I've presented above. Spontaneous trading decisions based on the current market situation are an inherently losing intraday trader's strategy.