Trade Analysis and Tips for Trading the Japanese Yen

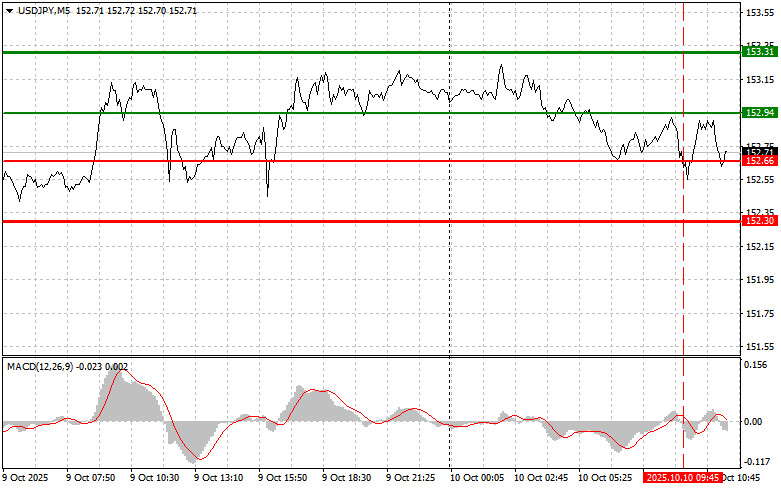

The price test of 152.66 in the first half of the day occurred when the MACD had just begun moving down from the zero line, which confirmed the correct entry point for selling the dollar. However, the pair never actually dropped.

Today, the key event for investors will be the public speeches by Austan D. Goolsbee and Alberto Musalem, representing the U.S. Federal Reserve. Recently, policymakers' remarks have increasingly suggested that the Fed might slow down rate cuts expected in October this year. Therefore, traders will focus closely on their statements, trying to forecast the regulator's future actions regarding monetary policy. Any signals of tighter control or, conversely, hints at a softer stance could trigger significant volatility in currency markets.

Along with Fed members' speeches, the release of the University of Michigan Consumer Sentiment Index will also be important. Even more significant, however, will be the data on inflation expectations, also published by the University of Michigan. Given the lack of statistics due to the shutdown, this parameter will be considered crucial. An increase in inflation expectations could drive stronger demand for the U.S. dollar, as it may push the Fed toward a more restrictive interest rate policy.

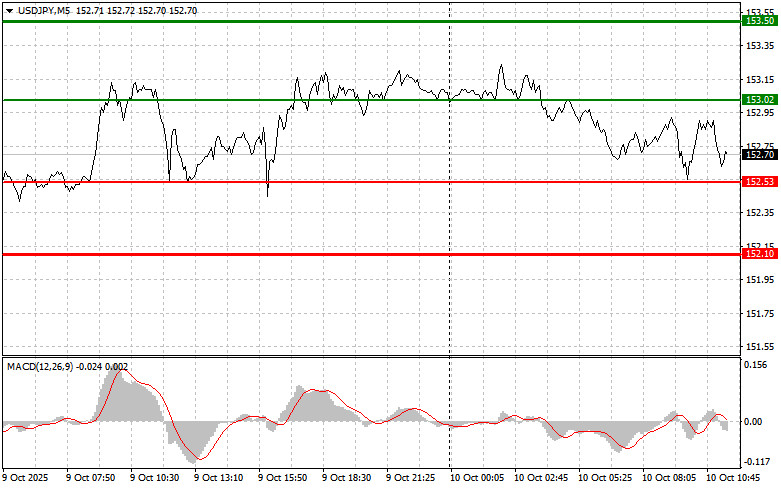

As for intraday strategy, I will rely more on implementing scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy USD/JPY today once the entry point around 153.02 (green line on the chart) is reached, targeting growth to 153.50 (thicker green line on the chart). Around 153.50, I will exit buy positions and open sell positions in the opposite direction (expecting a 30–35 point move in the opposite direction from that level). A continuation of the upward trend can be expected. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today if the price is tested twice consecutively at 152.53 while the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 153.02 and 153.50.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after breaking through the 152.53 level (red line on the chart), which will lead to a quick drop in the pair. The key target for sellers will be 152.10, where I will exit sales and also immediately open buys in the opposite direction (expecting a 20–25 point move in the opposite direction from that level). Pressure on the pair may return if Fed officials take a dovish stance. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today if the price is tested twice consecutively at 153.02 while the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a downward market reversal. A decline can be expected toward the opposite levels of 152.53 and 152.10.

What's on the Chart:

- Thin green line – entry price for buying the instrument.

- Thick green line – estimated price for setting Take Profit or manually fixing profit, since growth beyond this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – estimated price for setting Take Profit or manually fixing profit, since a decline beyond this level is unlikely.

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders must make entry decisions with great caution. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp exchange rate fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: for successful trading, it is necessary to have a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.