The GBP/USD currency pair also traded higher during the day, but with the same low volatility. In principle, all conclusions drawn in the EUR/USD article apply to the British pound. There is virtually no difference, as the British currency has also been flat for the last four months. This flat explains the completely illogical movements over the past few weeks. Recall that even last Friday, the U.S. dollar managed to appreciate despite the inflation report showing weaker growth in September, making the probability of a rate cut by the Fed in October and December nearly a certainty.

What do we have at the end of October? The U.S. government shutdown continues, Donald Trump keeps showering tariffs and sanctions like confetti on New Year's, the Fed is almost guaranteed to ease monetary policy at least twice, protests against Trump's policies in the U.S. continue and are becoming more colorful and larger, and the trade deal with China is essentially not a trade deal at all, but merely an extension of a temporary truce.

From a technical standpoint, the price has been flat for four months, and after a 1700-pip rise in the first half of 2025, it barely corrected by 38.2% according to Fibonacci. Thus, we have seen minimal correction within the scope of a new global upward trend. What can we expect from the pair given this technical picture and such a fundamental background?

It's also worth noting that the Bank of England may soon pause its easing of monetary policy. Inflation in the UK has been rising for over a year at a much higher pace than in the U.S. The fact that the consumer price index barely changed at the end of September doesn't alter the situation. Inflation remains nearly twice above the Bank of England's target level. Therefore, at its own risk, the BoE may lower rates one more time by the end of the year, further fueling inflation.

As a result, the Fed will likely cut rates by 90% in the next six months, all by itself. The dollar, remember, plummeted during the first half of the year as the BoE and the ECB actively eased monetary policy, while the Fed held back. Frankly, if we were asked to name a single factor in favor of the dollar right now, we wouldn't be able to do so. Previously, the American currency was regularly saved by its status as a "reserve currency" and a "safe haven." But in recent years, central banks worldwide have been looking to reduce their dollar reserves, logically deducing that one cannot "cook the porridge" with Trump in power. The entire world (or at least a large part of it) is forced to negotiate with Trump, rather than wanting to negotiate with him. As before, we foresee declines for the U.S. currency. The only question is when the flat will end.

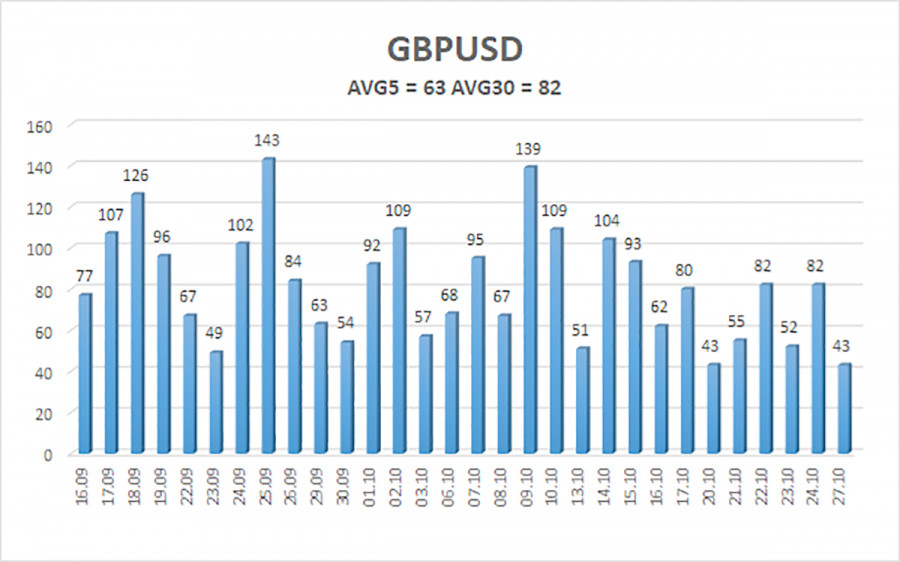

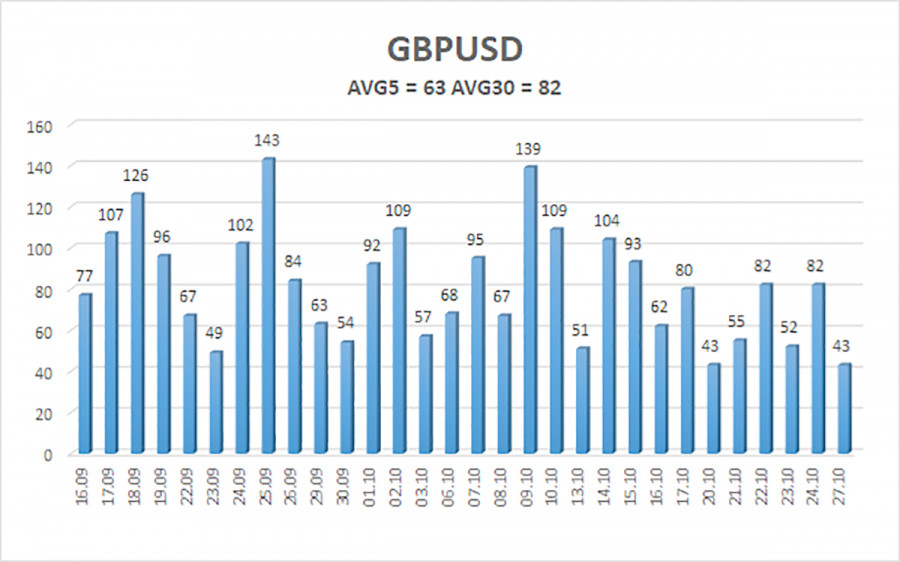

The average volatility of the GBP/USD pair over the last five trading days is 63 pips, which for the pound/dollar pair is considered "medium-low." Thus, for Tuesday, October 28, we expect movement within the range defined by the levels 1.3268 and 1.3394. The upper linear regression channel points upward, indicating a clear upward trend. The CCI indicator has entered the oversold area three times, warning of a potential resumption of the upward trend.

Nearest Support Levels:

- S1 – 1.3306

- S2 – 1.3245

- S3 – 1.3184

Nearest Resistance Levels:

- R1 – 1.3367

- R2 – 1.3428

- R3 – 1.3489

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the dollar, so we do not expect the dollar to appreciate. Therefore, long positions with targets of 1.3672 and 1.3733 remain much more relevant while the price is above the moving average. If the price is below the moving average line, small short positions can be considered with a target at 1.3268 on technical grounds. From time to time, the American currency shows corrections, but for a trend-based strengthening, it needs real signs of the end of the trade war or other global positive factors.

Explanations for the Illustrations:

- Linear regression channels help identify the current trend. If both are directed in the same direction, it indicates a strong trend.

- The moving average line (settings: 20.0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels serve as target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel the pair is likely to trade within over the next 24 hours, based on current volatility indicators.

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is imminent.