Analysis of Trades and Trading Tips for the British Pound

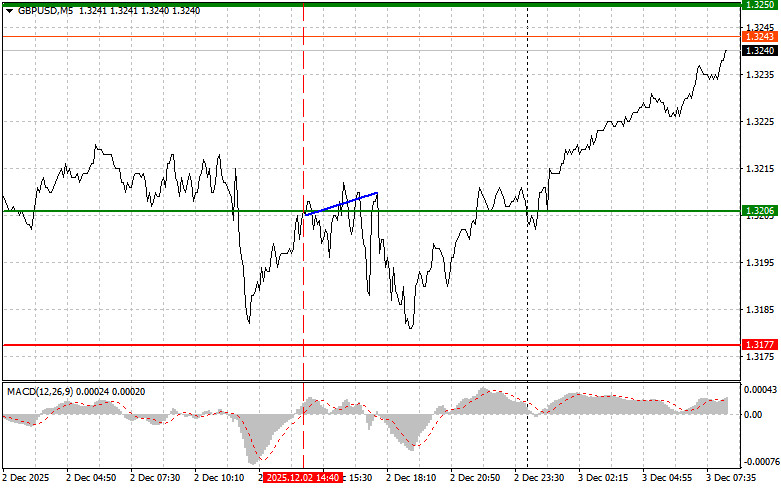

The test of the price at 1.3206 occurred when the MACD indicator was just starting to move upward from the zero mark, confirming a good entry point for buying pounds. However, a significant rise in the pair did not materialize.

Positive news about a sharp increase in the Economic Optimism Index from RCM/TIPP in the United States led to a strengthening of the dollar against the pound. The dollar's strengthening was a likely expected consequence of the data's release. The RCM/TIPP Economic Optimism Index, one of the key indicators of American consumer and investor sentiment, jumped significantly, signaling improved economic prospects in the U.S. This, in turn, increases the dollar's attractiveness as an investment asset.

Today, in the first half of the day, we are awaiting data on the UK Services PMI and the composite PMI, as well as a speech by Bank of England Monetary Policy Committee member Catherine L. Mann. Catherine Mann's speech may shed light on current sentiment within the BoE's Monetary Policy Committee, as some experts lean towards a more dovish stance for the BoE by year-end. Her comments regarding inflation, the labor market, and economic growth prospects will be closely analyzed by market participants to assess the likelihood of further interest rate cuts. Any disagreements within the MPC, if manifested in her speech, could lead to volatility in the currency market.

The Services PMI index will provide important information about the state of one of the key sectors of the British economy. Higher index values will indicate expanding activity, which could support the British pound. Conversely, a drop in the index below 50 points signals a contraction in activity and may trigger a negative reaction from investors. The composite PMI index, as an aggregated measure, will provide an overall view of the health of the British economy, combining data from both the manufacturing and services sectors. It is an important indicator for forecasting future GDP dynamics.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buying Scenarios

Scenario #1: I plan to buy pounds today when the price reaches the entry point around 1.3245 (green line on the chart), targeting a move to 1.3266 (thicker green line on the chart). I intend to exit the market at 1.3266 and sell immediately on the bounce, aiming for a 30-35-pip move from the entry point. Strong pound growth can only be expected after good economic data. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario #2: I also plan to buy pounds today if there are two consecutive tests of the price 1.3232 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. We can expect growth toward the opposite levels of 1.3245 and 1.3266.

Selling Scenarios

Scenario #1: I plan to sell pounds today after the pair reaches 1.3232 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the level of 1.3210, where I intend to exit the short positions and also buy immediately in the opposite direction (targeting a movement of 20-25 pips in the opposite direction from the level). The pound sellers will be activated if the reports are weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: I also plan to sell pounds today if there are two consecutive tests of the price 1.3245 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. We can expect a decline toward the opposite levels of 1.3232 and 1.3210.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.