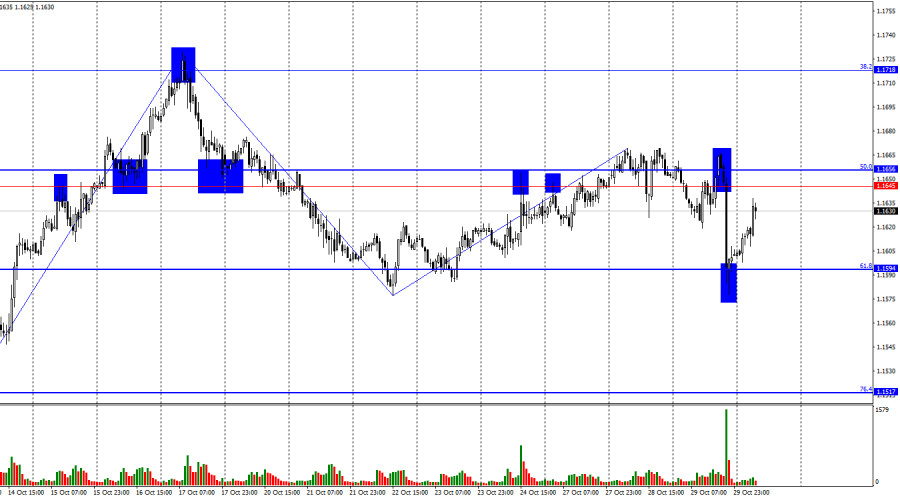

On Wednesday, the EUR/USD pair rebounded from the resistance level of 1.1645–1.1656, reversed in favor of the U.S. dollar, and fell to the 61.8% retracement level at 1.1594. A rebound from this level worked in favor of the euro, leading to renewed growth toward the 1.1645–1.1656 level. Today, another rebound from this area could trigger a new decline, while a firm close above it would increase the likelihood of continued growth toward the next 38.2% Fibonacci level at 1.1718.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave did not break the previous high, and the last downward wave did not break the previous low. Thus, for now, the trend remains bullish according to previous waves. Recent data on the labor market, the changed monetary policy outlook of the Fed, and the government shutdown are supporting the bulls. However, they continue to attack weakly, as if unwilling to move forward for reasons that remain unclear.

On Wednesday evening, the results of the FOMC meeting — the second-to-last meeting of the year — were announced. The interest rate was cut by 0.25%, as most traders expected. After the announcement, Jerome Powell stated that the decision was made to manage risks and bring the rate closer to a neutral level. However, regarding future meetings, Powell said that "that's an entirely different matter." Decisions will continue to be made meeting by meeting, based on incoming economic data. Therefore, he cannot guarantee or promise further monetary easing in December. Powell also emphasized that the shutdown has seriously hindered the Fed's ability to make informed decisions. Recall that, due to the suspension of federal operations in October, labor market and unemployment data were not published, and the inflation report was released with a significant delay.

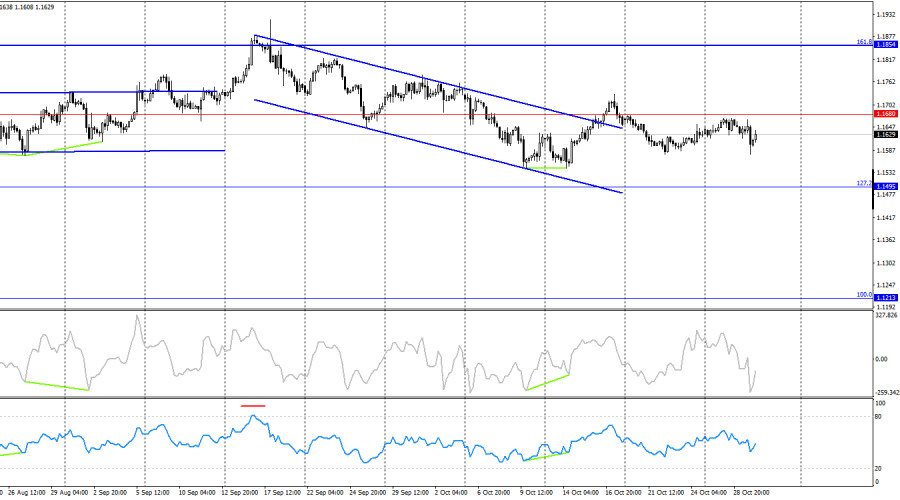

On the 4-hour chart, the pair reversed in favor of the U.S. dollar and consolidated below 1.1680, suggesting the potential for a slight decline. However, earlier there was also a breakout above the downward trend channel after the formation of a bullish divergence on the CCI indicator. Thus, the upward movement may resume toward the next 161.8% retracement level at 1.1854. Market movements are currently weak, so the hourly chart provides more meaningful signals for analysis.

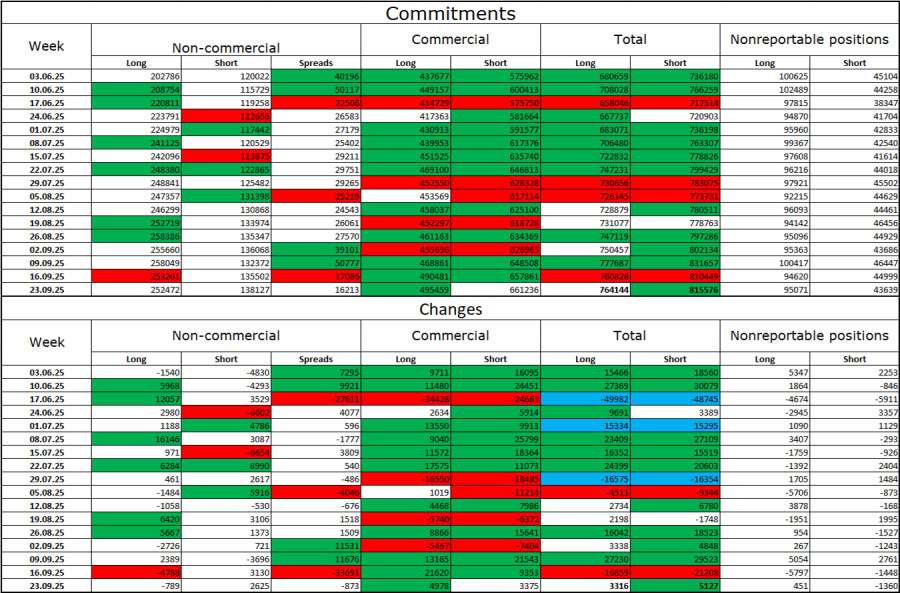

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 789 long positions and opened 2,625 short positions. No new COT reports have been released for a month. The sentiment among the Non-commercial group remains bullish, largely thanks to Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators now stands at 252,000, compared to 138,000 short positions — nearly a twofold difference.

Also note the large number of green cells in the table above — they indicate strong accumulation of long positions in the euro. In most cases, interest in the euro is rising, while interest in the dollar is declining.

For thirty-three consecutive weeks, large traders have been reducing their short positions and increasing longs. Donald Trump's policies remain the most significant factor for traders, as they could cause numerous long-term structural problems for the U.S. economy. Despite the signing of several key trade agreements, many core economic indicators continue to show decline.

News Calendar for the U.S. and the Eurozone:

- Germany – Unemployment rate (08:55 UTC)

- Germany – Change in unemployment (08:55 UTC)

- Germany – GDP growth (09:00 UTC)

- Eurozone – GDP change (10:00 UTC)

- Germany – Consumer Price Index (13:00 UTC)

- Eurozone – ECB interest rate decision (13:15 UTC)

- Eurozone – Christine Lagarde's press conference (13:45 UTC)

The October 30 economic calendar contains a large number of important events. The news background may have a strong impact on market sentiment Thursday.

EUR/USD Forecast and Trader Recommendations:

Selling was possible after a close below the 1.1645–1.1656 level on the hourly chart, with a target at 1.1594 — that target has been reached. New sales can be considered again after a rebound from the 1.1645–1.1656 level, with the same target. Buying opportunities could be considered on a rebound from 1.1594, or today — on a close above 1.1645–1.1656, with a target at 1.1718.

Fibonacci grids are built between 1.1392 – 1.1919 on the hourly chart and 1.1214 – 1.0179 on the 4-hour chart.