Trade Analysis and Recommendations for the British Pound

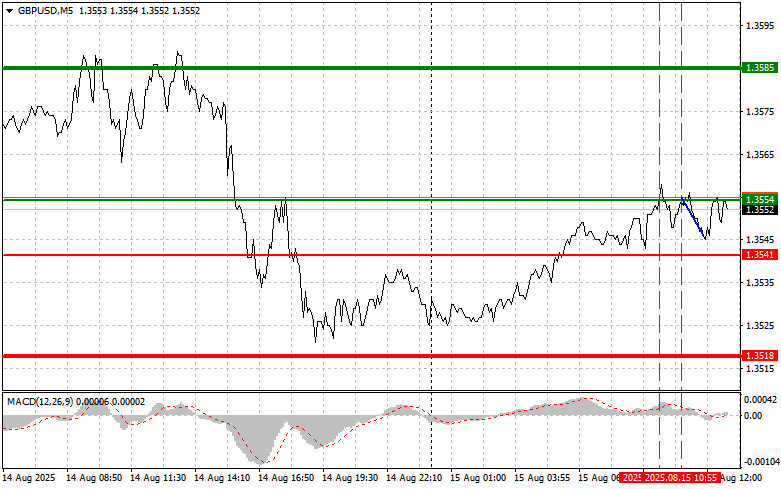

The test of 1.3554 occurred when the MACD indicator had moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the pound. The second test of 1.3554 occurred when the MACD was in the overbought zone, which allowed Scenario No. 2 for selling to play out and resulted in a 10-point drop in the pair.

The absence of U.K. statistics did not provide much support for the pound's growth. Traders are taking a wait-and-see approach, assessing the risks related to upcoming data from the U.K. and the U.S. At the same time, the U.S. dollar remains relatively weak on expectations of a softer monetary policy stance from the Federal Reserve.

In the second half of the day, traders' focus will be on U.S. retail sales and industrial production figures. These indicators, which reflect the state of consumer demand and the manufacturing sector, will provide insight into current economic growth dynamics and potential inflation risks. Retail sales data is traditionally viewed as an important barometer of consumer spending, which makes up a significant share of U.S. GDP. Steady growth in retail sales may indicate persistent inflationary pressures. Conversely, a slowdown in retail sales may point to economic weakness and the need to reconsider monetary tightening plans.

Equally important will be the industrial production figures, which will allow an assessment of the manufacturing sector's condition. Improvement in the data could signal recovery in industry, while a decline could indicate deepening recessionary trends.

For intraday strategy, I will mainly focus on implementing Scenarios No. 1 and No. 2.

Buy Signal

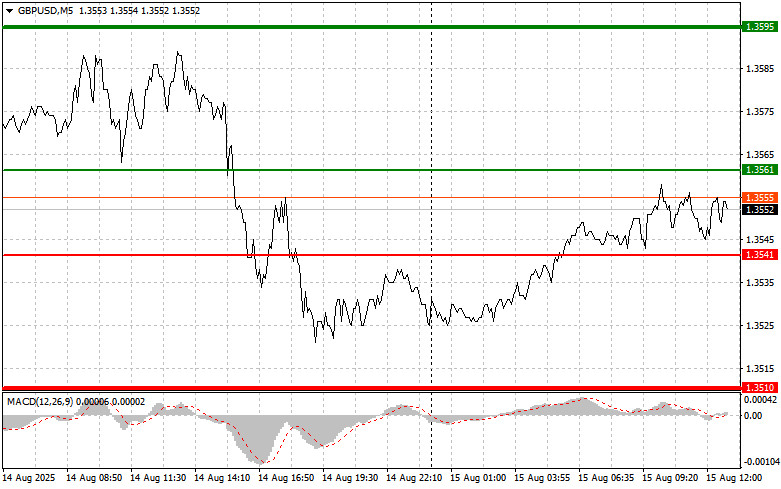

Scenario No. 1: I plan to buy the pound today at the entry point around 1.3561 (green line on the chart) with a target of rising to 1.3595 (thicker green line on the chart). Around 1.3595, I will exit buy positions and open sales in the opposite direction, aiming for a 30–35-point move in the reverse direction from that level. Pound growth today can be expected after weak U.S. statistics. Important: Before buying, make sure the MACD indicator is above the zero line and only starting to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of 1.3541 when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. A rise toward the opposite levels of 1.3561 and 1.3695 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after it breaks below 1.3541 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3510, where I will exit sell positions and immediately open buys in the opposite direction, aiming for a 20–25-point move in the reverse direction from that level. Sellers will likely come into play today if U.S. statistics are strong. Important: Before selling, make sure the MACD indicator is below the zero line and only starting to fall from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of 1.3561 when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.3541 and 1.3510 can be expected.

Chart Key:

- Thin green line – entry price for buying the instrument;

- Thick green line – estimated price for placing Take Profit orders or taking profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – estimated price for placing Take Profit orders or taking profit manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to take into account overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when making entry decisions. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is initially a losing strategy for an intraday trader.