Trade Review and Advice on Trading the Euro

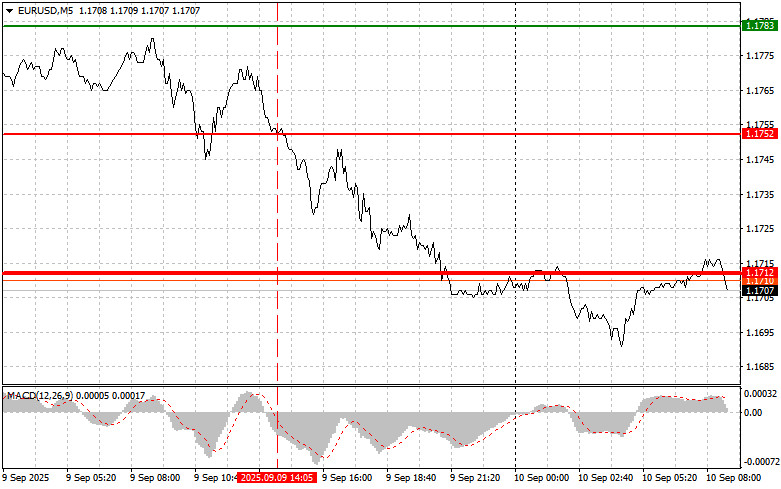

The price test at 1.1752 occurred when the MACD indicator had already moved significantly down from the zero mark, which, in my opinion, limited the downward potential of the pair. For this reason, I did not sell the euro.

Despite the absence of key economic data from the United States, the dollar was able to partially recover its previously lost ground. This indicates that market participants chose to take a cautious stance, refraining from active trading. Nevertheless, such restraint may be misleading. Market conditions are still shaped by several factors that could put considerable pressure on the US currency in the future. Foremost among these are the ongoing debates about the future course of Federal Reserve monetary policy. This uncertainty fosters speculation and makes the dollar weaker. In addition, geopolitical instability and slowing global economic growth negatively affect investor sentiment, pushing them into safer assets.

Today brings data on Italian industrial production. These figures are unlikely to set the direction for EUR/USD, but they are what we have. Given the low economic activity in the eurozone, any positive signal from Italian industry will support the euro and strengthen its position against the US dollar. However, it is essential to consider potential risks. Disappointing results, on the other hand, will fuel concern, reduce investor confidence in the euro, and lead to its depreciation. Markets react quickly to any signs of instability and are ready to put pressure on the euro at the slightest deterioration in Italy's economic situation. It should be understood that a simple increase in production volumes does not always signal a sustainable recovery. It is important to consider the structure of industrial production, export order dynamics, and overall economic circumstances. Only a comprehensive analysis will reveal whether Italy's industry is truly overcoming the crisis or if this is just a temporary phenomenon.

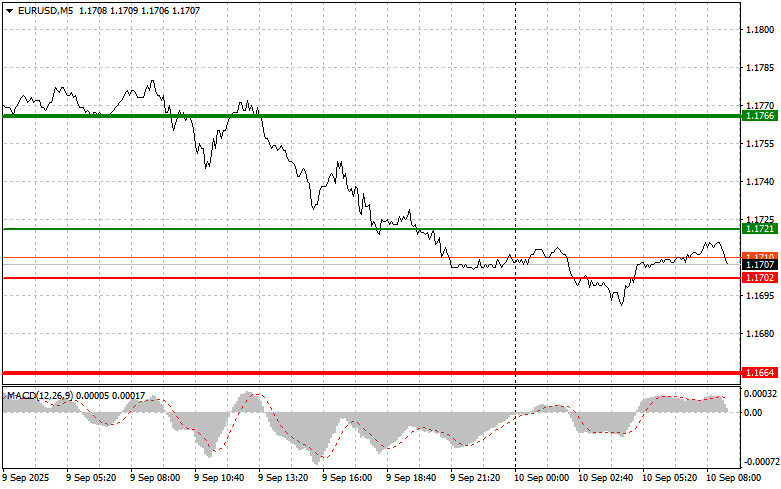

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

Scenario #1: You can buy the euro today if the price reaches the area of 1.1721 (green line on the chart), targeting growth to 1.1766. At the 1.1766 point, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30-35 pip move from the entry. Rely on euro growth only after strong data. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1702 price when the MACD indicator is in the oversold zone. This limits the pair's downward potential and leads to an upward reversal. Growth is expected toward the opposite levels of 1.1721 and 1.1766.

Sell Scenario

Scenario #1: I plan to sell the euro after the 1.1702 level (red line on the chart) is reached. The target is 1.1664, where I plan to exit the market and buy immediately in the opposite direction (aiming for a move of 20–25 pips in the opposite direction from this level). Selling pressure on the pair will return if the data is weak. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to drop from it.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of the price at 1.1721 when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. Expect a decline to the opposite levels of 1.1702 and 1.1664.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.