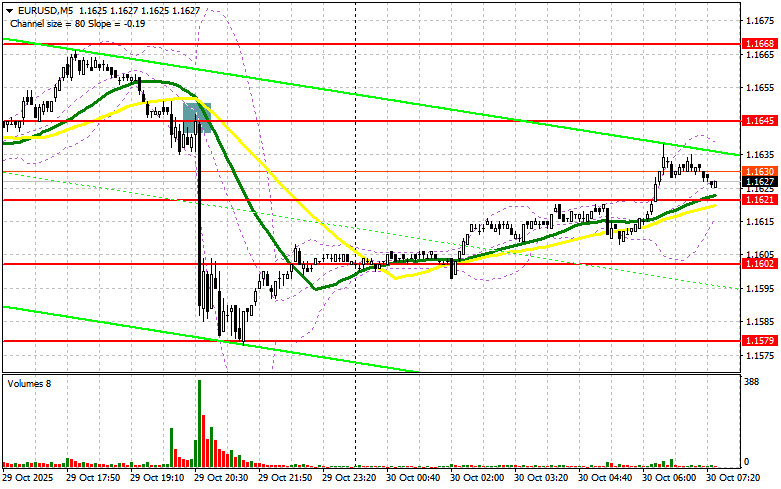

Yesterday, several entry points into the market were formed. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the level of 1.1621 and planned to make entry decisions based on it. A decline and the formation of a false breakout around 1.1621 provided a good entry point to buy euros, leading to a 25-pip upward move in the pair. In the afternoon, an unsuccessful attempt to rise above 1.1645 prompted traders to enter short positions, resulting in a significant sell-off in the euro to around 1.1579.

For Opening Long Positions on EUR/USD:

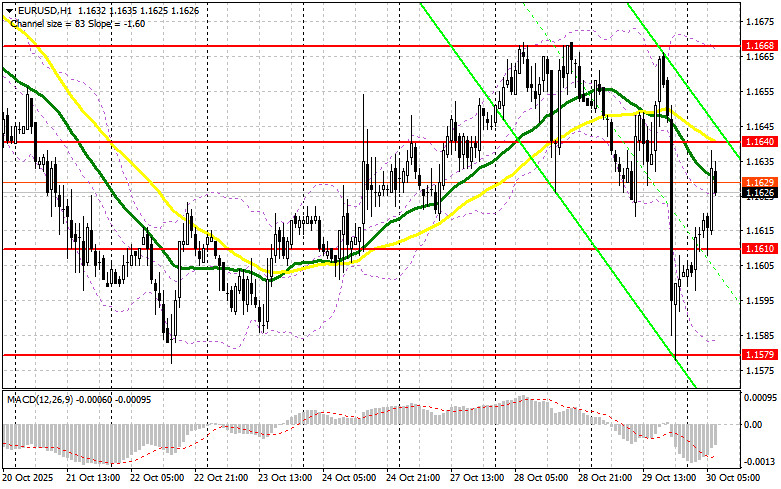

Yesterday, the US Federal Reserve reduced interest rates by a quarter point, which should have led to a decline in the dollar. However, that did not happen, as Federal Reserve Chair Jerome Powell hinted that the reduction might be the last this year, which restored demand for the US dollar. Today, in the first half of the day, data on Eurozone GDP changes, unemployment levels, and Germany's consumer price index are expected. If the indicators are favorable, the euro may partially recover its losses. In the event of another decline in the pair, a false breakout around 1.1610 would provide an entry point for long positions aiming for recovery to the resistance at 1.1640, formed from yesterday's results. A breakout and a retest of this range would confirm the action to buy euros in anticipation of a larger movement towards 1.1668. The furthest target will be the 1.1696 area, where I will take profits. A test of this level would return the upward trend for the euro. If EUR/USD declines and there is inactivity around 1.1610, pressure on the pair will increase again, possibly leading to a larger sell-off of the euro. Sellers are likely to reach the next interesting level of 1.1579—the last hope for the bulls. Only the formation of a false breakout there would provide a suitable condition to buy euros. I plan to open long positions immediately on a bounce from 1.1545, targeting an upward correction of 30-35 pips within the day.

For Opening Short Positions on EUR/USD:

Sellers have not shown themselves during Asian trading, so it's better not to rush into shorts. The main task for bears in the first half of the day will be defending the nearest resistance at 1.1640. Only after a false breakout can they think about moving the euro down to the support at 1.1610. A breakthrough and consolidation below this range, along with a retest from below, will provide another suitable option to open short positions targeting 1.1579. The further target will be the area of 1.1545, where I will take profits. In case of an upward move in EUR/USD and a lack of active bearish action around 1.1640, where the moving averages are aligned with sellers, it is better to postpone short positions until the larger level of 1.1668. Selling there will occur only after an unsuccessful consolidation.

Recommended for Your Review:

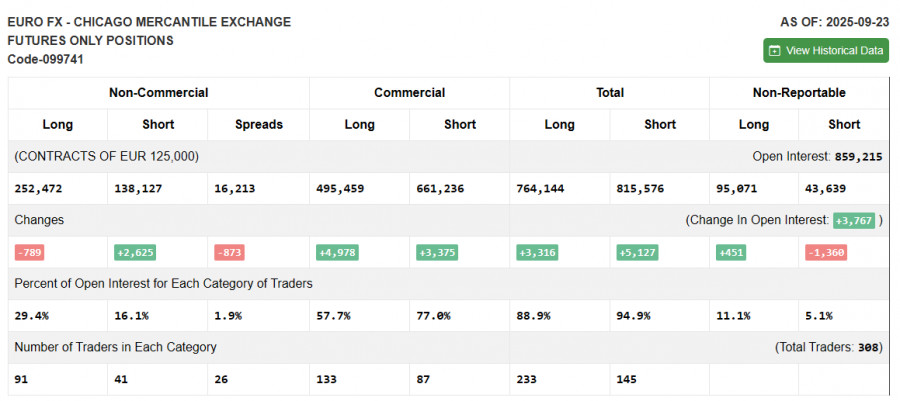

Due to the ongoing US shutdown, fresh Commitment of Traders (COT) data has not been published. The last relevant report is from September 23.

In the COT report for September 23, there was an increase in short positions and a decrease in long positions. Expectations of further Federal Reserve rate cuts continue to pressure the US dollar. However, there hasn't been an increase in euro buyers, as political issues in France and risks of a new inflation spike are causing the European Central Bank to act much more cautiously, slowing economic growth. The COT report indicates that long non-commercial positions decreased by 789 to 252,472, while short non-commercial positions increased by 2,625 to 138,625. As a result, the spread between long and short positions shrank by 873.

Indicator Signals:

Moving Averages: Trading occurs below the 30 and 50-day moving averages, indicating clear challenges for the euro in gaining strength.

Bollinger Bands: In the event of a decline, the indicator's lower boundary will provide support around 1.1585.

Indicator Descriptions:

- Moving Average: Defines the current trend by smoothing volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving Average: Defines the current trend by smoothing volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-Commercial Traders: Speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long Non-Commercial Positions: Total long open position of non-commercial traders.

- Short Non-Commercial Positions: Total short open position of non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.