Analysis of Trades and Trading Tips for the British Pound

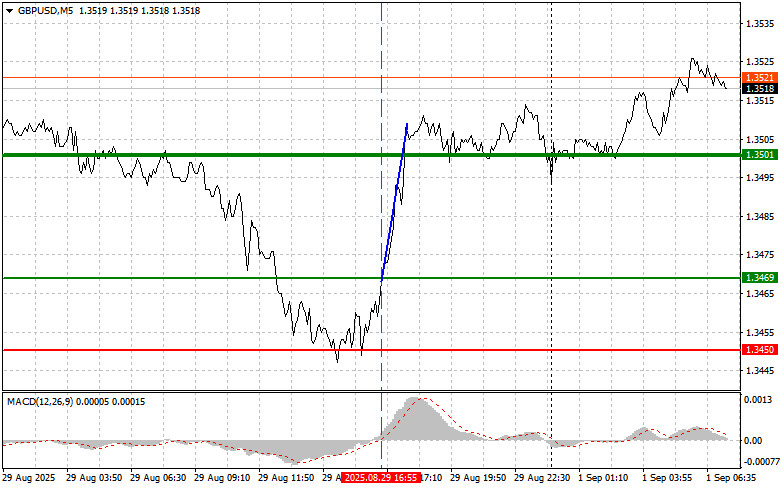

The test of the 1.3469 price level coincided with the moment when the MACD indicator was starting to move up from the zero line, confirming the correct entry point for buying the pound and resulting in a gain of over 30 pips.

The US Personal Consumption Expenditures Index matched economists' forecasts, which weakened the dollar against the British pound and increased the chances of a Federal Reserve rate cut this month. However, the market's reaction was restrained, as investors realized that the Fed would act cautiously, analyzing incoming economic data and assessing potential risks. A rate cut could be viewed as a political decision, undermining trust in the central bank. At the same time, the strengthening of the British pound is linked to expectations of a more cautious monetary policy from the Bank of England. Inflation in the UK remains persistently high, prompting the central bank to maintain a hawkish stance. The interest rate differential in favor of the pound puts additional pressure on the dollar.

Today is rich in UK economic releases. The day will start with the release of the Nationwide House Price Index and the Manufacturing PMI, and will conclude with data on approved mortgage loans and M4 money supply dynamics. The Nationwide House Price Index is expected to show modest growth, indicating continuing stability in the UK housing market. However, it is worth noting that the pace of growth may slow relative to previous periods, as higher borrowing costs continue to impact consumer purchasing power.

The Manufacturing PMI is likely to remain below the 50 level, indicating ongoing challenges for UK industry. Any improvement over the previous month will be viewed positively by the market, although significant growth seems unlikely.

Overall, today's UK data will provide important insights into the country's economic health, so traders should closely watch these figures to assess potential risks and opportunities in the FX market.

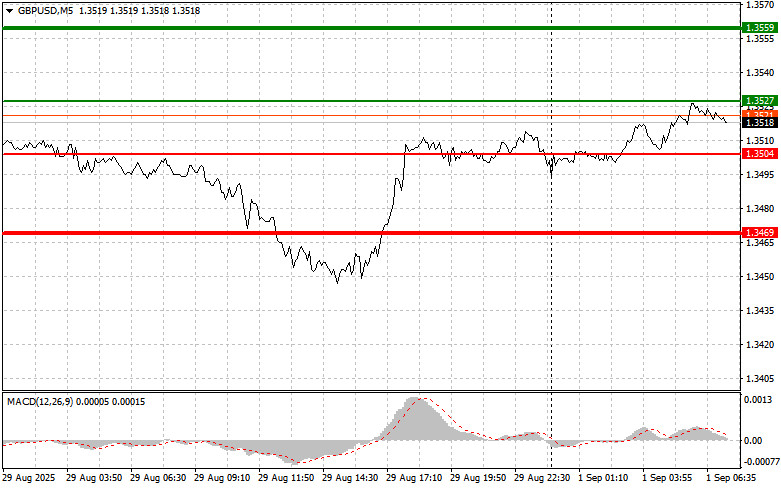

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

- Scenario #1: I plan to buy the pound today if the entry point is reached around 1.3527 (green line on the chart), targeting a rise to 1.3559 (the thicker green line on the chart). Around 1.3540, I plan to exit buys and open sells on the pullback (looking for a 30–35 pip move in the opposite direction from this level). Only strong data make it reasonable to expect pound growth today. Important! Before buying, ensure the MACD indicator is above zero and is just starting to move upward from it.

- Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3504 while the MACD is in the oversold area. This will limit the pair's downside potential and prompt a market reversal upward. Growth can be expected toward the 1.3527 and 1.3559 levels.

Sell Scenario

- Scenario #1: I plan to sell the pound today after a break below the 1.3504 level (red line on the chart), which will likely trigger a rapid decline. The key target for sellers will be 1.3469, where I plan to exit sells and immediately open buys on the rebound (aiming for a 20–25 pip move in the opposite direction from that level). Sellers may become much more active after weak data. Important! Before selling, ensure the MACD is below zero and is just starting to move downward from this level.

- Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3527 while the MACD is in the overbought area. This will limit the upside potential for the pair and prompt a downward reversal. Look for a move down to the 1.3504 and 1.3469 levels.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.