The GBP/USD currency pair traded lower on Friday, continuing its downward trajectory throughout the past trading week, as the market seized any opportunity to sell the pound and buy dollars. We still believe that the nature of the current decline in the pair is purely technical; market manipulation may be occurring, and the fundamental and macroeconomic background has little relevance to the current strengthening of the US dollar. On Friday, there were no news releases in either the US or the UK, yet sell-offs continued in the first half of the day.

Having analyzed the nature of the current movement, several important points should be highlighted. Unfortunately, there is no corresponding trend line for sterling on the weekly timeframe, as seen with the euro, so we turn to the daily chart. Despite a two-week decline, the price remains within the sideways channel of 1.3140–1.3780. We understand that a 600-point channel is not appealing to anyone, but flat trends on higher timeframes also occur regularly.

The next point to note is that, as of today, the price has attempted to move below the 1.3140 level three times and has not succeeded. For those familiar with our cryptocurrency articles, this is indicative of "liquidity removal." Therefore, it can be said that liquidity has been removed since the low recorded on August 1. Liquidity removal is always a manipulation. Such movements do not align with logic and regularity—precisely what we have been observing over the past month.

Thus, we believe there is a high probability of final liquidity removal from the August 1 low, aimed at a subsequent reversal and significant markup of the currency pair. Moving to the 4-hour timeframe, the CCI indicator has entered the oversold area (below -250) four times in the last two months. Each such entry has been accompanied by a sharp reversal and a rise. Due to the flat nature of the daily timeframe, growth has not developed in the long term; however, the price cannot go lower either.

Last week, the CCI indicator entered the oversold area for the fourth time, and the continued decline of the British currency is surprising given the fundamental backdrop. Thus, we still believe that an upward reversal will occur very soon. Of course, one can wait for confirmation of this hypothesis at the hourly or 4-hour time frame. By the way, next week, the Bank of England will hold its penultimate meeting of the current year. Naturally, the results may be interpreted against the British currency if the number of Monetary Policy Committee members voting for a rate cut is higher than anticipated. However, a new month is starting, which is a good time to establish a new trend.

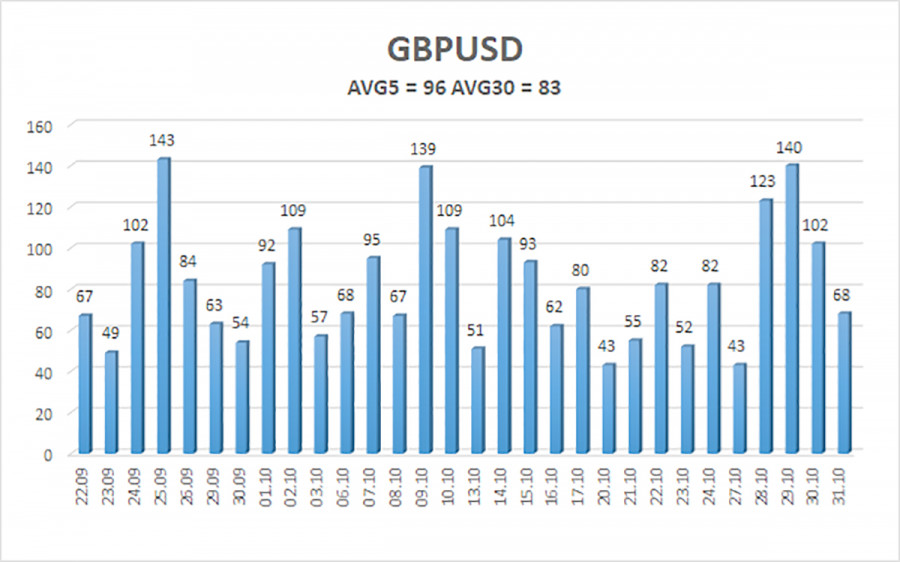

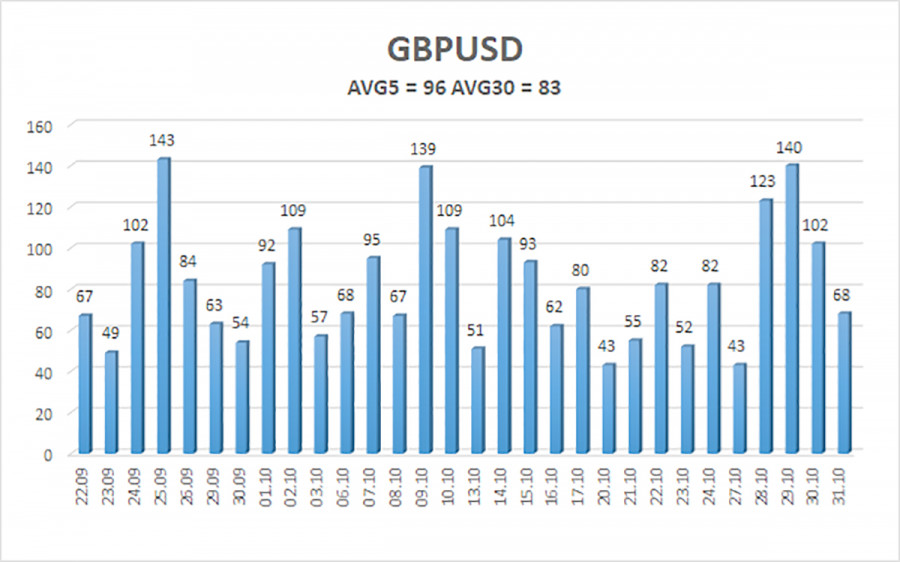

The average volatility of the GBP/USD pair over the last five trading days is 96 pips, which is considered "average" for the pound/dollar pair. On Monday, November 3, we expect movement within the range of 1.3055-1.3247. The upper channel of linear regression is directed downwards, but only due to the 4-month flat trend. The CCI indicator has entered the oversold area four times, warning of a potential resumption of the upward trend.

Nearest Support Levels:

Nearest Resistance Levels:

- R1 – 1.3184

- R2 – 1.3245

- R3 – 1.3306

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Currently, the daily timeframe still displays a flat trend. Thus, long positions with targets of 1.3672 and 1.3733 remain much more relevant while the price is above the moving average. If the price is below the moving average, minor shorts can be considered with targets of 1.3062 and 1.3055 on technical grounds. From time to time, the US currency shows corrections, but for a trend to strengthen, it requires concrete signs of the conclusion of the trade war or other global positive factors.

Explanations for the Illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, it indicates a strong trend right now.

- The moving average line (settings of 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel the pair will trade in the next day, based on current volatility parameters.

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.