Trade Analysis and Tips for the British Pound

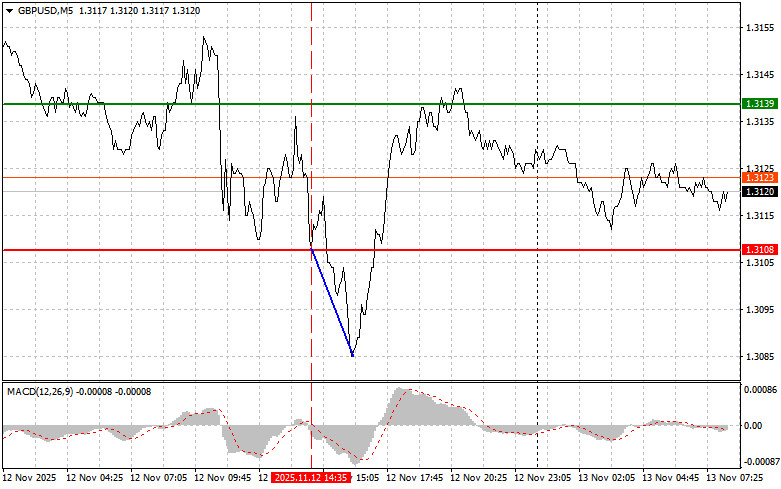

The price test at 1.3108 occurred when the MACD indicator was beginning its downward move from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair dropped by 20 pips.

The resumption of US government operations brought relief to hundreds of thousands of federal employees who had been placed on unpaid leave or worked without pay for 43 days. However, this did not support the US dollar.

The H.R. 5371 bill only funds the government temporarily until January 30, 2026. This means that political battles will resume shortly. Congress and the White House will need to find a compromise by that date to avoid another potentially more damaging shutdown.

Today, in the first half of the day, rather important data on GDP growth in the UK, changes in industrial production, and the trade balance in goods are expected. Investors will closely monitor these indicators in an attempt to gauge the state of the British economy and the possible actions of the Bank of England in the near future. Surprises in either direction could cause sharp fluctuations in the pound sterling. Particular attention will be given to GDP dynamics. Growth exceeding expectations will bolster the positions of those who believe the British economy is resilient to external shocks. Conversely, weak GDP data, as currently expected, will heighten concerns about a recession and prompt the Bank of England to revert to a more dovish monetary policy. Changes in industrial production are also an important indicator. Growth in production suggests increased economic activity and rising demand, while a decline indicates a weakening economy. The trade balance will show how successfully the UK competes in the global market. A trade balance deficit could exert pressure on the pound.

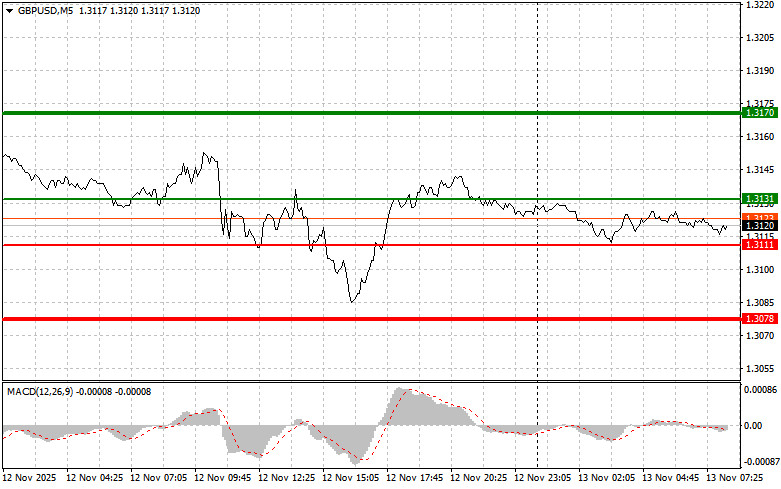

Regarding the intraday strategy, I will primarily rely on implementing Scenario #1 and Scenario #2.

Buy Scenarios

- Scenario #1: Today, I plan to buy the pound at an entry point around 1.3131 (green line on the chart), targeting a move to 1.3170 (thicker green line on the chart). At 1.3170, I plan to exit the market and also sell in the opposite direction, anticipating a movement of 30-35 pips from the entry point. Pound growth can only be expected after strong data is released. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

- Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3111 while the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward market reversal. One can expect growth to the opposing levels of 1.3131 and 1.3170.

Sell Scenarios

- Scenario #1: I plan to sell the pound after the 1.3111 level (red line on the chart) is breached, which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3078 level, where I intend to exit the short positions and immediately buy in the opposite direction, anticipating a move of 20-25 pips from there. Sellers of the pound will return only with very weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

- Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3131 while the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downward. One can expect a decrease to the opposing levels of 1.3111 and 1.3078.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.