Analysis of Trades and Trading Tips for the Euro

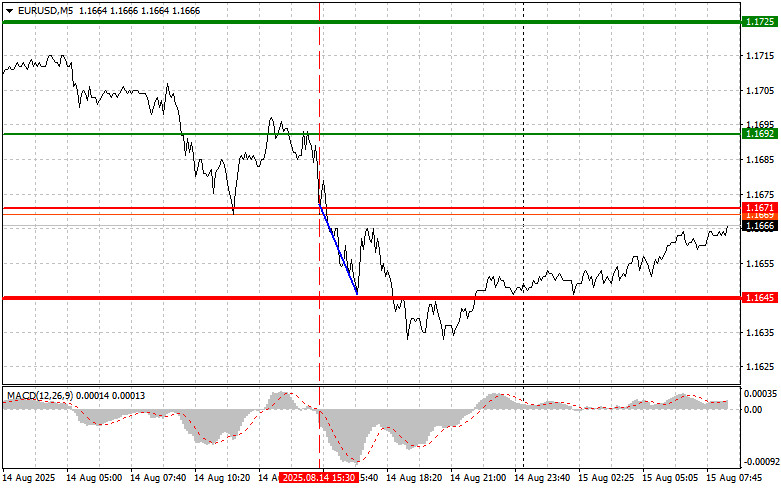

The test of the 1.1671 price level occurred when the MACD indicator had just started moving down from the zero mark, which confirmed a correct entry point for selling the euro and resulted in a 30-point drop.

A sudden increase in the U.S. Producer Price Index by 0.9% triggered a similar surge in the U.S. dollar's exchange rate against the euro. Market participants interpreted this information as an indication that the Federal Reserve might take more restrictive measures regarding the key interest rate. However, the strengthening of the dollar against the euro is the result of a complex interplay of several factors, and the U.S. inflation data only reinforced already emerging trends. Looking ahead, the EUR/USD pair's dynamics will be determined by further actions of the Fed and the European Central Bank, as well as developments in the geopolitical situation.

Today, in the absence of key economic releases, EUR/USD volatility may decrease. Accordingly, the focus shifts to the upcoming meeting of EU finance ministers. It is expected that the summit will address issues related to inflationary pressures and future economic growth rates in the eurozone. Any statements or decisions made could have a significant impact on the value of the European currency. Investors will be paying close attention to signs of the EU governments' readiness to continue cooperating in resolving current issues. Special attention will also be given to any comments regarding the possibility of further interest rate cuts by the ECB. A more aggressive ECB stance could strengthen the euro, while cautious remarks hinting at continued economic support through monetary policy could exert downward pressure.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

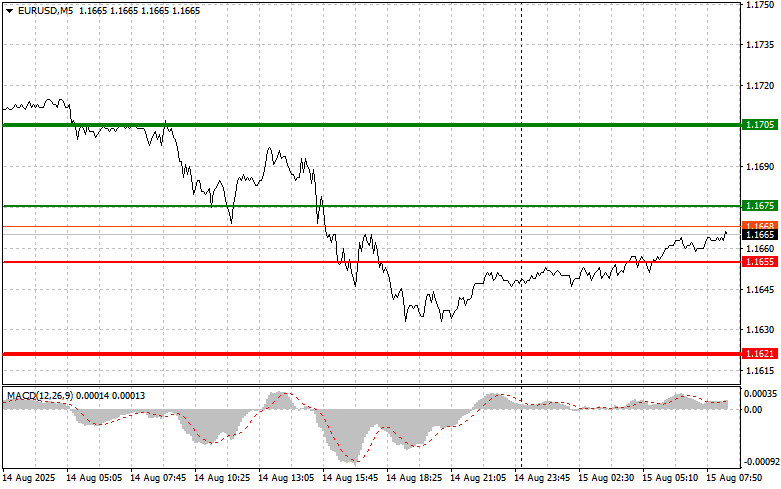

Scenario #1: Today, I plan to buy the euro upon reaching the 1.1675 level (green line on the chart) with a target of rising to 1.1705. At 1.1705, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Growth in the euro may be expected within the observed upward trend. Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1655 price level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Growth can be expected toward the opposite levels of 1.1675 and 1.1705.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches the 1.1655 level (red line on the chart). The target will be the 1.1621 level, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move in the opposite direction from this level). Strong pressure on the pair is possible today as a continuation of yesterday's trend. Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1675 price level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.1655 and 1.1621 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.