Analysis of Trades and Trading Tips for the British Pound

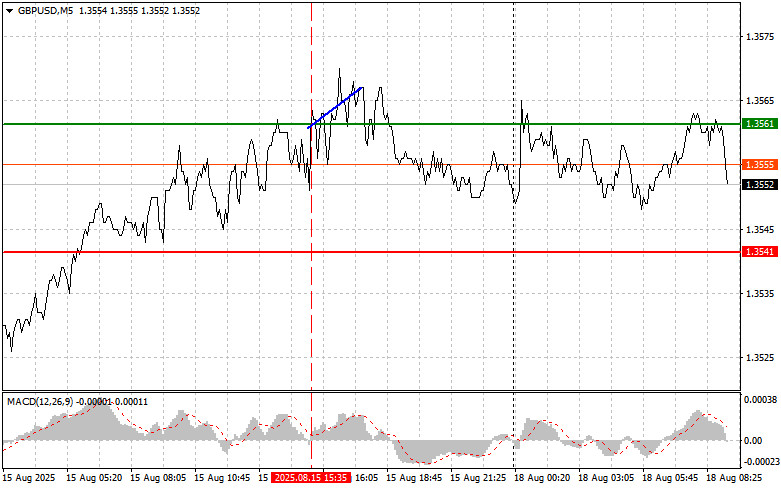

The test of 1.3561 occurred at a time when the MACD indicator was beginning to move upward from the zero line, which confirmed the correct entry point for buying the pound. However, despite the data, a major rise in the pair did not follow.

U.S. retail sales data disappointed. This indicates that the American economy continues to lose momentum, which will force the Federal Reserve to act more dovishly in the near future. Indeed, the figures came in noticeably below expectations, casting doubt on the stability of consumer demand, which until recently remained a key driver of U.S. economic growth. This worrying signal, combined with U.S. labor market data, suggests a likely slowdown in business activity, putting the Fed in a difficult position. On one hand, the Fed still faces the task of curbing inflation, which, despite signs of slowing, remains above the target level. On the other hand, weak retail sales and labor market data point to the need to support the economy. Lowering interest rates may stimulate consumer demand and investment, helping to avoid a deeper economic crisis, but at the same time, all of this would lead to further price pressures.

Today, there are no reports from the UK, so pound buyers will retain a chance. The absence of macroeconomic news is a kind of market calm, when previously formed sentiment continues to dominate. In this situation, after a recent positive impulse, the pound may take advantage of the lack of headwinds and show further strengthening. However, it should be remembered that the foreign exchange market is rarely one-sided. Calm can suddenly turn into a storm – a single unexpected piece of news or statement is enough for the trend to reverse in the opposite direction. Therefore, despite the favorable conditions, traders should remain cautious and not forget about risk management.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

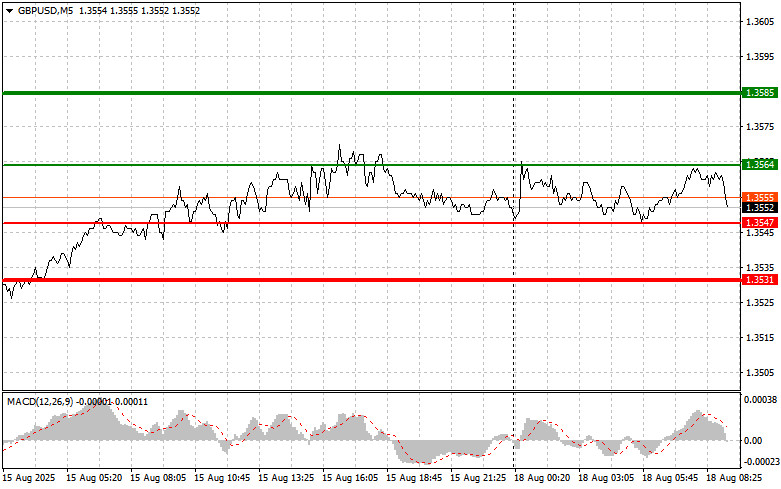

Scenario 1: I plan to buy the pound today at the entry point around 1.3564 (green line on the chart) with a target at 1.3585 (thicker green line on the chart). Around 1.3585, I plan to exit buys and open sell positions in the opposite direction (expecting a move of 30–35 points in the opposite direction from that level). Some growth in the pound can be expected today, but it is unlikely to be strong.

Important! Before buying, make sure the MACD indicator is above the zero line and only starting to rise from it.

Scenario 2: I also plan to buy the pound today in the event of two consecutive tests of 1.3547, when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.3564 and 1.3585 can be expected.

Sell Scenario

Scenario 1: I plan to sell the pound today after the level of 1.3547 (red line on the chart) is updated, which will lead to a quick decline in the pair. The key target for sellers will be 1.3531, where I plan to exit sells and immediately open buys in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Pound sellers may return at any moment today, taking advantage of low trading volumes.

Important! Before selling, make sure the MACD indicator is below the zero line and only starting to decline from it.

Scenario 2: I also plan to sell the pound today in the case of two consecutive tests of 1.3564, at the moment when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.3547 and 1.3531 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.