Analysis of Trades and Trading Tips for the Japanese Yen

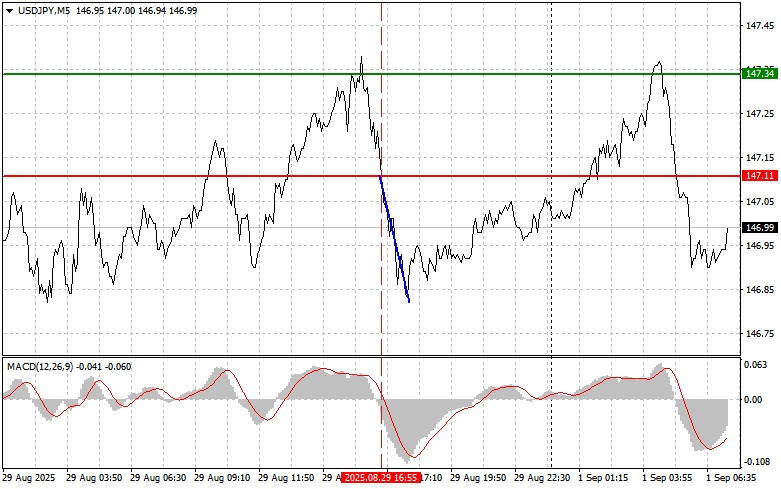

The test of the 147.11 price level coincided with the moment when the MACD indicator was starting to move down from the zero line, confirming the correct entry point for selling the dollar. As a result, the pair declined by 25 pips.

Friday's US Personal Consumption Expenditures (PCE) index did not surprise and matched economists' forecasts, which weakened the dollar against the Japanese yen. However, it's too early to count the dollar out. The market's response was moderate, reflecting investors' understanding of the complex dilemma facing the Federal Reserve. On one hand, weak inflation data creates room for monetary easing. On the other hand, cutting rates too early could reignite inflation and weaken the dollar further, which is unacceptable.

The weakening of the dollar against the yen, in turn, reflects not only the US situation but also the yen's own dynamics. The Bank of Japan is not yet planning to tighten monetary policy, but there are signs that changes may come by year's end. This supports the yen, despite the general weakness in the Japanese economy. Japan's weak Manufacturing PMI is direct evidence of this.

The published data, which indicate a contraction in the manufacturing sector, deepen concerns about the overall trajectory of the Japanese economy. A reduction in export orders, caused by global economic uncertainty and weaker demand from major trading partners, has a negative impact on manufacturing metrics.

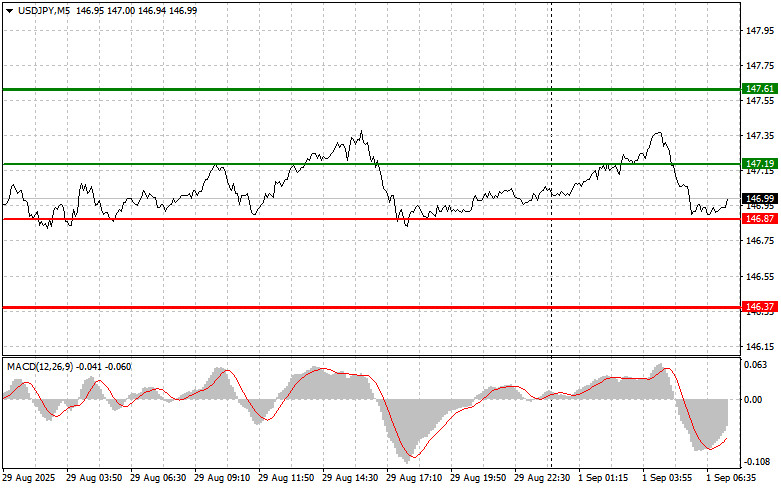

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

- Scenario #1: I plan to buy USD/JPY today if the entry point, around 147.19 (green line on the chart), is reached, targeting a rise to 147.61 (thicker green line on the chart). Around 147.61, I plan to exit buys and open sells on the pullback (targeting a 30–35 pip move in the opposite direction from this level). It's better to buy the pair during corrections and significant USD/JPY pullbacks. Important! Before buying, ensure the MACD indicator is above zero and is just starting to move upward from it.

- Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of 146.87 while the MACD is in the oversold area. This will limit the pair's downside potential and prompt a reversal upward. Growth can be expected toward the 147.19 and 147.61 levels.

Sell Scenario

- Scenario #1: I plan to sell USD/JPY today only after a break below 146.87 (red line on the chart), which is expected to trigger a rapid decline. The key target for sellers will be 146.37, where I plan to exit sells and immediately open buys on the rebound (aiming for a 20–25 pip move in the opposite direction from this level). The higher the sell, the better. Important! Before selling, ensure the MACD is below zero and is just starting to move downward from this level.

- Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of 147.19 while the MACD is in the overbought area. This will limit the upside for the pair and prompt a downward reversal. Look for moves down towards 146.87 and 146.37.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.