Trade Review and Advice on Trading the British Pound

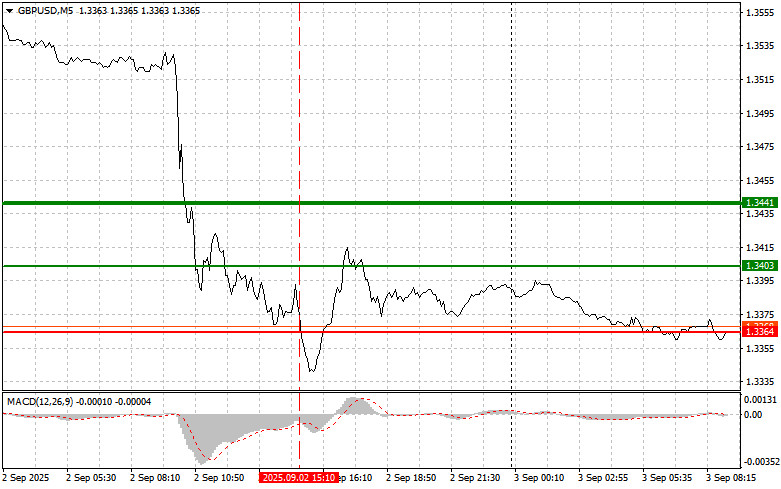

The test of the 1.3364 price occurred when the MACD indicator had already dropped significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound.

Weak US manufacturing activity data only provided temporary support for the pound against the dollar. The previously published manufacturing PMI caused a brief burst of optimism, but it essentially did not change the overall picture of dollar dominance.

This morning, attention will be focused on the release of the UK services PMI, the composite PMI, and the speech by Bank of England Financial Policy Committee member Sarah Breeden. These events will undoubtedly set the tone for trading the British currency and affect market sentiment. The state of the services sector, as a vital component of the UK economy, is reflected in the business activity index for this area. If the number is above 50, it signals sector growth; if below, contraction. Analyzing this information helps assess the prospects for UK economic growth and influences investment decisions regarding the pound. The composite PMI, which combines data from the manufacturing and services sectors, gives a broader view of economic activity. Investors will be watching this indicator to gauge prevailing economic trends.

Sarah Breeden's speech will attract increased interest. Market participants will look for indications of how the central bank assesses inflation, the labor market, and other key economic parameters. Any hints of adjustments to interest rates or other monetary policy tools could spark a burst of volatility in the currency market and cause sharp swings in the pound's exchange rate.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

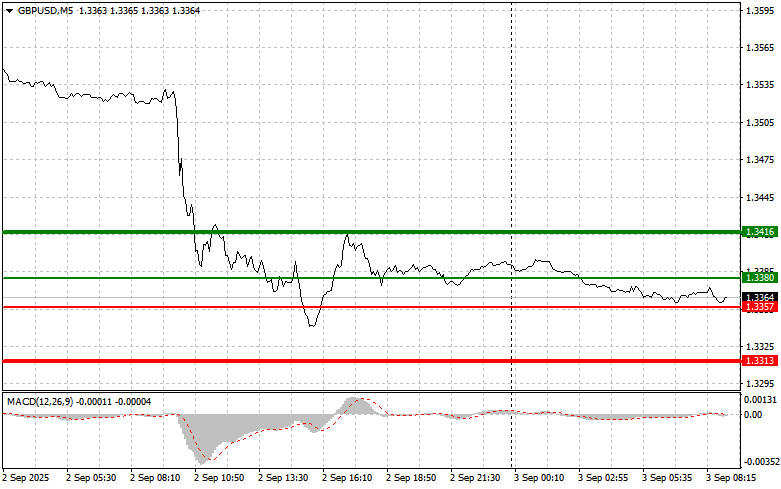

Scenario #1: Today, I plan to buy the pound when the entry point around 1.3380 (green line on the chart) is reached, with a target of rising to 1.3416 (thicker green line on the chart). Around 1.3416, I plan to exit purchases and open short trades in the opposite direction (aiming for a move of 30–35 points the other way). Counting on a rise in the pound today is possible only after very good data. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: Today, I also plan to buy the pound in the event of two consecutive tests of the 1.3357 level when the MACD is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth can be expected towards the opposite levels at 1.3380 and 1.3416.

Sell Scenario

Scenario #1: I plan to sell the pound today after the 1.3357 level (red line on the chart) is updated, which will lead to a rapid decline in the pair. The key target for sellers will be 1.3313, where I plan to exit the sale and immediately open a long position in the opposite direction (looking for a move of 20–25 points back the other way). Pound sellers can return at any moment today—especially after weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3380 level when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A drop can be expected towards the opposite levels of 1.3357 and 1.3313.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.