Wednesday Trade Review:

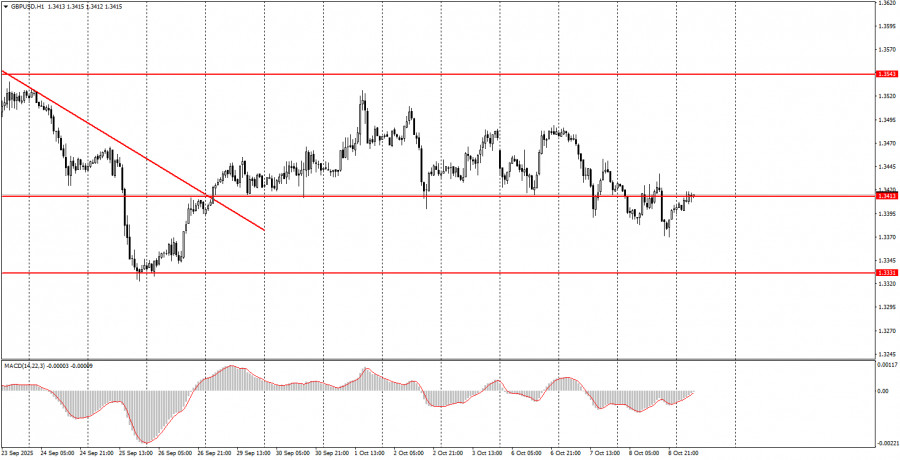

1-Hour GBP/USD Chart

On Wednesday (and into Thursday), the GBP/USD pair continued a weak downward movement — despite having virtually no fundamental reason for doing so. Let's recall that the trend for the pound turned bullish after the downward trendline was broken. There's been no meaningful macroeconomic or fundamental news for the British currency this week. On the other hand, U.S. developments — including the ongoing government shutdown and unrest in Chicago — clearly don't favor dollar strength. Last week's U.S. economic data fell short of expectations, and the Federal Reserve is expected to cut rates two more times before year-end.

All of this strongly suggests the dollar should be weakening, not strengthening. Therefore, we view the current decline in the GBP/USD as completely illogical.

In theory, the euro's decline might be pulling the pound down due to a strong correlation; however, even this explanation is debatable. While losses in GBP are not large, they occur at a time when the currency should logically be rising. In short, intraday movements remain chaotic and poorly structured.

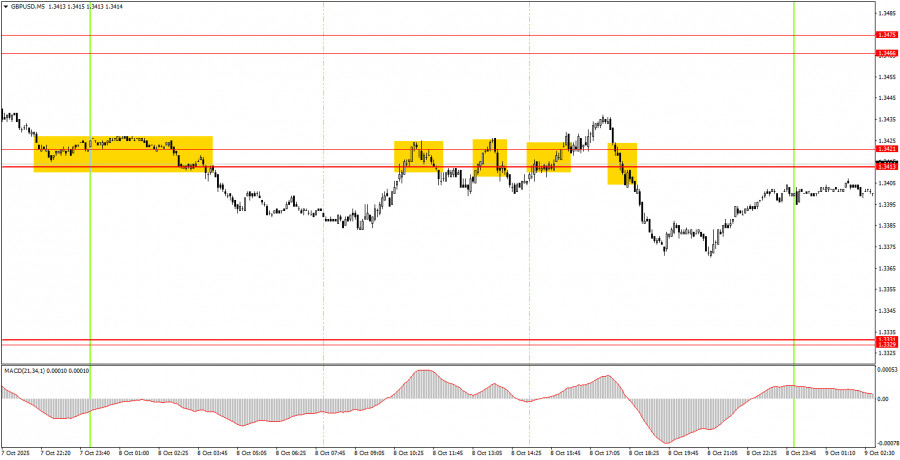

5-Minute GBP/USD Chart

On the 5-minute timeframe, we are seeing a situation similar to EUR/USD. Price action has started to ignore support/resistance levels altogether. While trade signals are still forming, they rarely reach their targets.

For example, in yesterday's trading around the 1.3413–1.3421 zone, four signals were generated — all of them false. Therefore, beginner traders need to understand that market logic is currently lacking, and short-term price action is volatile and unpredictable.

How to Trade on Thursday:

On the hourly chart, GBP/USD has ended its previous downtrend, but any attempt at a reversal to the upside has yet to gain traction. As we noted, there are no credible reasons for the U.S. dollar to strengthen in the medium term; therefore, we still expect a bullish movement for GBP/USD over time.

However, market conditions remain strange. The pound continues to fall without a clear justification, and technical structures are being disrupted. It is possible to trade based on technical signals on lower timeframes (M5), but price movements remain inconsistent regardless of the timeframe.

On Thursday, the GBP/USD pair may continue to move downward, especially since the price has broken through the 1.3413–1.3421 area. Still, given current market conditions, unpredictable upward pullbacks and disregard for established zones or resistance levels are likely.

Here are the key support and resistance zones on the 5-minute timeframe: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763.

There are no major economic events scheduled for the UK on Thursday. However, Jerome Powell's speech in the U.S. could cause sharp volatility, depending on what the Fed Chair says. Powell's statement will be a key event, especially given the Fed's current rate-cutting cycle and the general uncertainty in U.S. policy. Be prepared for sudden movements in either direction as the market reacts.

Basic Rules of the Trading System:

- The strength of a signal is determined by how quickly it forms (a bounce or breakout). The faster the signal forms, the stronger it is.

- If two or more false trades occur around a particular level, that level should be ignored for future signals.

- In a sideways market (flat), any pair may generate many false signals — or none at all. In such a case, it's better to step away from trading at the first signs of consolidation.

- Trades should be executed between the start of the European session and the midpoint of the U.S. session. All trades should be manually closed thereafter.

- On the 1-hour timeframe, only trade MACD signals when volatility is high and a trendline or trend channel confirms the trend.

- If two levels are located very close together (within 5–20 pips), treat them as a support or resistance zone.

- Once a trade moves 20 pips in the intended direction, set your Stop Loss to break even.

Chart Annotations:

- Support and resistance levels are target areas for potential buy or sell entries. Use them to set Take Profit levels.

- Red lines indicate trend channels or trendlines that reflect the current direction of the market. They help determine preferred trade direction.

- MACD (14,22,3): The histogram and signal line can be used for additional confirmation of trade direction.

Important speeches and reports (always listed in the economic calendar) can heavily influence currency pair movement. During their release, you should trade with extra caution or exit the market entirely to avoid sharp price swings against your position.

For beginners in forex trading: remember that not every trade will be profitable. Developing a clear strategy and effective money management are essential for long-term success in trading.