Trade Analysis and Advice on the Euro

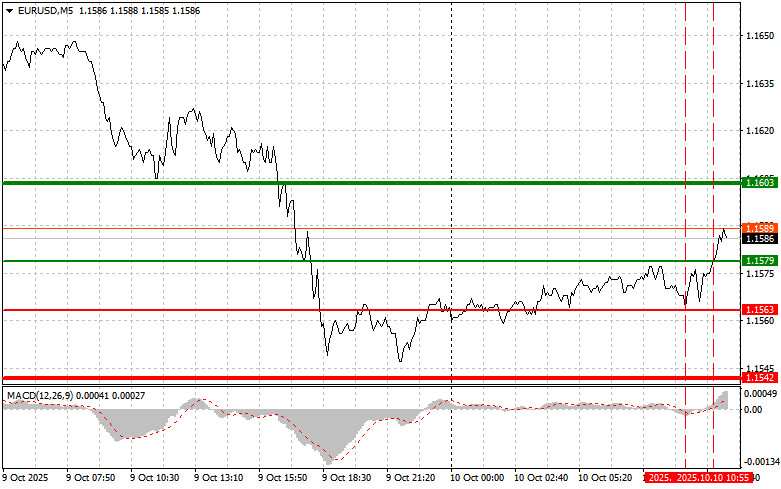

The test of 1.1563 occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro.

Predictably, in the absence of key economic data from the eurozone, the euro showed a modest rise in the first half of the day. This pause in the series of negative factors that had been weighing on the euro in recent days led to a slight easing of tensions in financial markets. Overall economic instability and ongoing political problems in France continue to exert significant negative pressure on the single currency. Most experts agree that for the euro to strengthen sustainably, more substantial drivers are needed — such as improvements in macroeconomic indicators and a more consistent monetary policy strategy from the European Central Bank.

During the U.S. trading session, investors will focus on the release of the University of Michigan's consumer sentiment and inflation expectations data. In addition, speeches by Federal Open Market Committee members Austan D. Goolsbee and Alberto Musalem are scheduled. These factors are likely to add volatility to trading, providing market participants with information for analysis and possibly triggering new asset price swings. The Consumer Sentiment Index is an important indicator of the U.S. economy's health. Encouraging results can boost confidence in stable consumer spending, which supports the dollar. Disappointing results, on the other hand, may raise concerns and lead to stronger euro gains at the end of the week. Inflation expectations are of particular importance, as they have a substantial influence on Federal Reserve monetary policy.

The speeches of Austan D. Goolsbee and Alberto Musalem will be the central event of the day. Diverging views within the FOMC could spark uncertainty and instability, while coordinated signals may strengthen market optimism, favoring the dollar.

As for intraday strategy, I will focus more on Scenarios #1 and #2.

Buy Signal

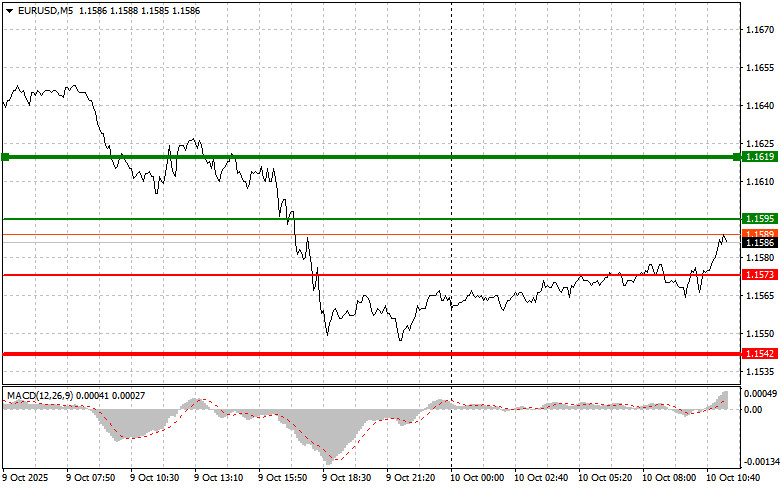

Scenario #1: Buy the euro today at around 1.1595 (green line on the chart), targeting growth toward 1.1619. At 1.1619, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. Euro growth today will only be realistic if the Fed representatives deliver dovish remarks.Important! Before buying, make sure the MACD indicator is above zero and just beginning to rise from that level.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1573 level at a time when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1595 and 1.1619 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1573 level (red line on the chart). The target will be 1.1542, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move in the opposite direction from this level). Downward pressure on the pair could return at any moment today.Important! Before selling, make sure the MACD indicator is below zero and just beginning its decline from that level.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1595 level when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1573 and 1.1542 can then be expected.

What's on the chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – projected price for setting Take Profit or manually locking profit, since further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – projected price for setting Take Profit or manually locking profit, since further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important for beginners: On the Forex market, you must be very cautious when deciding on entries. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you do trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember: to trade successfully, you must have a clear trading plan, like the one outlined above. Spontaneous decisions based on current market conditions are an inherently losing strategy for intraday traders.