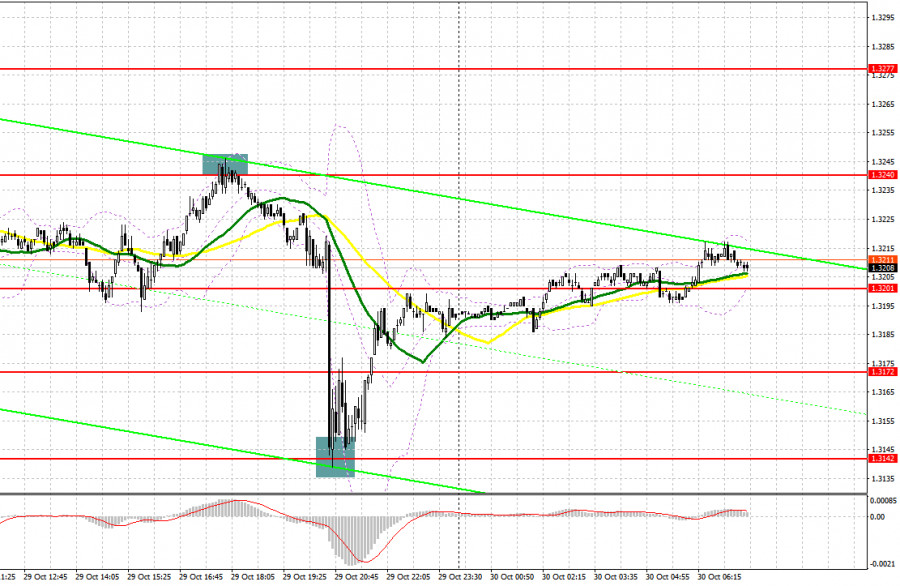

Several entry points were formed in the market yesterday. Let's look at the 5-minute chart and analyze what happened. In my morning forecast, I focused on the 1.3228 level and planned to base my market entry decisions on it. A decline and the formation of a false breakout around 1.3228 provided a buying point for the pound, but the pair did not rise, resulting in a loss. In the afternoon, short positions on the false breakout near 1.3240 yielded about 100 pips of profit. Longs in the 1.3142 area led to a correction of more than 40 pips in the pair.

For Opening Long Positions on GBP/USD:

Yesterday, the British pound sharply declined after Powell said future rate decisions depend on incoming data and that the October cut was merely risk management. According to him, the future is uncertain, and there is no guarantee that the rate will be cut again in December. Unfortunately, there are no reports for the UK today, so traders will have little to rely on in the first half of the day. However, it is evident that in a declining pound environment, caution is necessary for any buying actions. A false breakout around the nearest support at 1.3197 will be a reason to open long positions, targeting an increase to the resistance at 1.3244, as seen in yesterday's results. A breakout and retest of this range will increase the chances of GBP/USD strengthening, triggering stop orders from sellers and providing a suitable entry point for long positions, with a potential target of 1.3277. The furthest target will be the 1.3310 area, where I will take profits. Should GBP/USD decline and buyers become inactive at 1.3197, the pair may continue its bearish trend, leading to movement toward 1.3168. Only the formation of a false breakout there will provide a suitable condition for buying euros. I plan to buy GBP/USD immediately on a bounce from the low of 1.3142, targeting a correction of 30-35 pips within the day.

For Opening Short Positions on GBP/USD:

Sellers maintain control over the market, so the British pound faces challenges when it rises today. The first sign of bears is expected around the 1.3244 resistance level, where moving averages are aligned with sellers. A false breakout there will be sufficient to sell the pound, targeting a decline toward support at 1.3197, where I expect to see the first sign of bulls. A breakout and retest below this range will deliver a more significant blow to buyers' positions, triggering stop losses and opening the way to 1.3168. The furthest target will be the 1.3142 area, where I will take profits. If GBP/USD rises and there is a lack of activity around 1.3244, buyers will have an opportunity for further gains. In this case, it is better to postpone selling until the resistance at 1.3277 is tested. I plan to open short positions only after a false breakout there. If there is no downward movement, I will sell GBP/USD immediately on a bounce from 1.3310, but only in anticipation of a 30-35-pip downward correction within the day.

Recommended for Your Review:

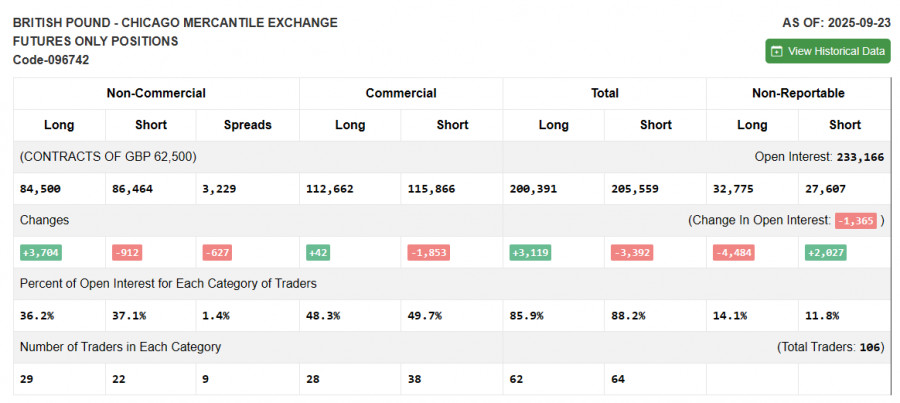

Due to the ongoing US shutdown, fresh Commitment of Traders (COT) data is not being published. The last relevant report is from September 23.

The COT report for September 23 showed a decrease in short positions and an increase in long positions. The pressure on the dollar remains, especially following the latest data that will likely compel the Federal Reserve to continue lowering interest rates. Meanwhile, the Bank of England's policy remains cautious, indicating its clear plans for further inflation control, although this has not instilled significant confidence in pound buyers lately. The short-term dynamics of the GBP/USD exchange rate will be determined by new fundamental reports. The latest COT report indicates that long non-commercial positions increased by 3,704 to 84,500, while short non-commercial positions fell by 912 to 86,464. As a result, the spread between long and short positions decreased by 627.

Indicator Signals:

Moving Averages: Trading is occurring below the 30 and 50-day moving averages, indicating ongoing issues with the pound's growth.

Bollinger Bands: In the event of a decline, the indicator's lower boundary will act as support around 1.3168.

Indicator Descriptions:

- Moving Average: Defines the current trend by smoothing volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving Average: Defines the current trend by smoothing volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-Commercial Traders: Speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes that meet certain criteria.

- Long Non-Commercial Positions: Total long open position of non-commercial traders.

- Short Non-Commercial Positions: Total short open position of non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.