The GBP/USD currency pair has once again settled below the moving average line on Wednesday and now risks falling even lower. Despite the pair's decline over the past nearly two months, largely without significant reasons and justifications, we still view this movement as a correction. In other words, we do not see any prospects for the dollar while Trump remains the president of the United States. Even the break of the price out of the sideways channel on the daily timeframe has not prompted us to change our stance.

The British pound has had nearly 5% more reasons to decline over the past month and a half compared to the euro, which has had virtually none. The euro has remained flat for several months, while the pound sterling has also remained flat for an extended period but has dropped below the channel by those very 5%.

In the UK, the situation is not very good either. If it were not for Donald Trump, we would not expect the pound to grow as much in 2025. Let's remind ourselves that the pound has been on a global downward trend for the last 17 years, during which it fell from $2.12 to $1.04.

This week, UK macroeconomic data have already disappointed, with the unemployment rate rising to 5%. But is the macroeconomic data in the US any better? It simply doesn't exist, and that doesn't improve the situation. It should also be remembered that the US Supreme Court may rule this week on the legality of the import tariffs that Trump imposed in 2025, which he continues to use as his main tool for exerting pressure on opponents. There is a high probability that the Supreme Court will make the same decision as the two "lower" courts – the Appeals and Trade courts. However, it is already known that the Court can make whatever decision it wants; however, this will not stop Trump, as we are in the most democratic country in the world.

If the Supreme Court were to repeal all trade tariffs, Trump would reinstate them under another law that may also contain no mention of tariffs. The US President interprets any law as he pleases. For instance, if a law does not state "tariffs cannot be imposed," it means tariffs can be imposed. We take the Animal Welfare Act and impose trade tariffs based on it. Then let the American courts spend another six months deliberating whether Trump had the right to impose tariffs based on yet another legislative act. And this can continue indefinitely. Democracy and the rule of law in all their glory. Hence, the trade war with the US and the rest of the world is bound to last a long time, and we are confident we will witness more than one escalation.

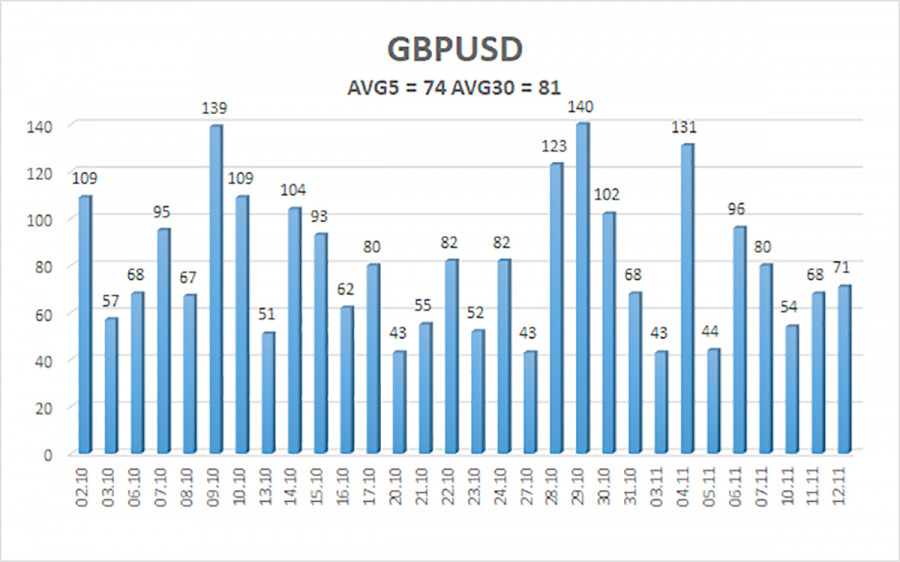

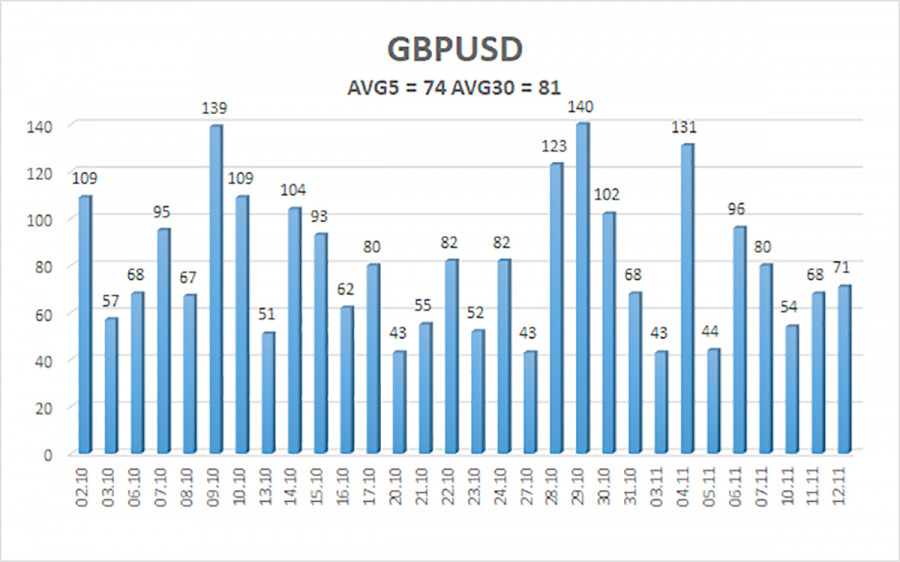

The average volatility of the GBP/USD pair over the last five trading days is 74 pips. For the pound/dollar pair, this figure is considered "average." On Thursday, November 13, we expect the pair to trade between 1.3056 and 1.3204. The upper channel of linear regression is directed downward, but this is due to technical correction on higher timeframes. The CCI indicator has entered the oversold area four times (!!!), which warns of a resumption of the upward trend. A new bullish divergence has formed, from which the last wave of growth began.

Nearest Support Levels:

S1 – 1.3062

S2 – 1.2939

S3 – 1.2817

Nearest Resistance Levels:

R1 – 1.3184

R2 – 1.3306

R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to pressure the dollar, so we do not expect the American currency to grow. Therefore, long positions with targets at 1.3306 and 1.3428 remain relevant in the near term if the price remains above the moving average. If the price is below the moving average, small shorts can be considered with targets of 1.3062 and 1.2939 based on technical grounds. From time to time, the American currency shows corrections (in a global perspective), but for trend strengthening, it needs real signs of the completion of the trade war or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, it indicates that the trend is currently strong.

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will spend the following days, based on current volatility indicators.

- The CCI indicator entering the oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.