El par de divisas EUR/USD el lunes continuó negociándose de forma súper tranquila. El trasfondo macroeconómico estuvo ausente por segundo día de negociación consecutivo, y el trasfondo fundamental el mercado por ahora lo analiza más que lo ejecuta. Recordemos que en este momento existen varios temas muy resonantes e importantes que los participantes del mercado seguramente aún no han trabajado. En primer lugar, la posible tregua entre Rusia y Ucrania. En segundo lugar, los nuevos aranceles de Donald Trump, que en gran medida dependen de las negociaciones entre Kiev y Moscú. En tercer lugar, la posible reducción global de las tasas de interés de la Fed, que podría comenzar en septiembre.

Sobre las negociaciones entre Ucrania y Rusia, por ahora no hay mucho que decir. Los Estados han iniciado el proceso de negociación varias veces en los últimos 3,5 años, pero cada vez todo terminaba en nada, ya que tanto Kiev como Moscú quieren obtenerlo todo sin ceder nada. Si esta vez las delegaciones llegan a Alaska con esas exigencias, el fracaso de las negociaciones está asegurado. Por muy influyente que sea Trump, no es el Amo del mundo, por lo que es muy posible que el conflicto bélico continúe.

Los aranceles de Donald Trump deben dividirse en dos categorías: aranceles relacionados con la injusticia comercial hacia EE.UU., y aranceles destinados a sofocar la financiación de la guerra en Ucrania. La primera categoría ya es algo establecido y habitual. Cada pocas semanas Trump introduce otro paquete de aranceles para aquellos países que, por razones desconocidas, se habían librado de ellos anteriormente. En esencia, Trump considera que absolutamente todo el mundo utiliza a Estados Unidos para su propio enriquecimiento, pero al mismo tiempo no paga las cuentas, bloquea el acceso de los productos estadounidenses a sus mercados y no quiere tener un balance comercial equilibrado. Por ello, esta categoría de aranceles seguirá creciendo como hongos después de la lluvia.

Los aranceles relacionados con la presión sobre Rusia son más interesantes. Por un lado, Donald Trump hace todo lo posible por sentar a Kiev y Moscú en la mesa de negociaciones, y ya incluso ha programado su reunión personal con Vladímir Putin, en la que también podría estar presente Volodímir Zelenski. Pero al mismo tiempo, Trump impuso aranceles a India en respuesta a su negativa a comprar petróleo, gas y armas rusas. Y ahora está pensando en aumentar los aranceles a China por las mismas razones, aunque paralelamente mantiene conversaciones con el gigante asiático sobre un acuerdo comercial.

Como dijimos hace unos meses, Trump estará buscando constantemente razones y pretextos para introducir nuevos aranceles. Las negociaciones sobre un acuerdo con China aún no han terminado, y Trump ya planea imponer nuevos aranceles. El presidente de EE.UU. simplemente busca excusas convenientes para nuevas sanciones, que al mismo tiempo llenarán las arcas estadounidenses. Un esquema muy conveniente. A nosotros, en principio, nos da igual contra quién imponga Trump los aranceles, porque serán los estadounidenses quienes los paguen. Las exportaciones de muchos países se verán afectadas, pero a este ritmo, tarde o temprano, todo el mundo comenzará a reorientarse de la economía estadounidense hacia otras, como está sucediendo ahora con el dólar estadounidense. El proceso no es rápido, pero todos entienden perfectamente que con Trump "no se cuece arroz". Hoy llegas a un acuerdo, mañana el presidente de EE.UU. impone nuevos aranceles.

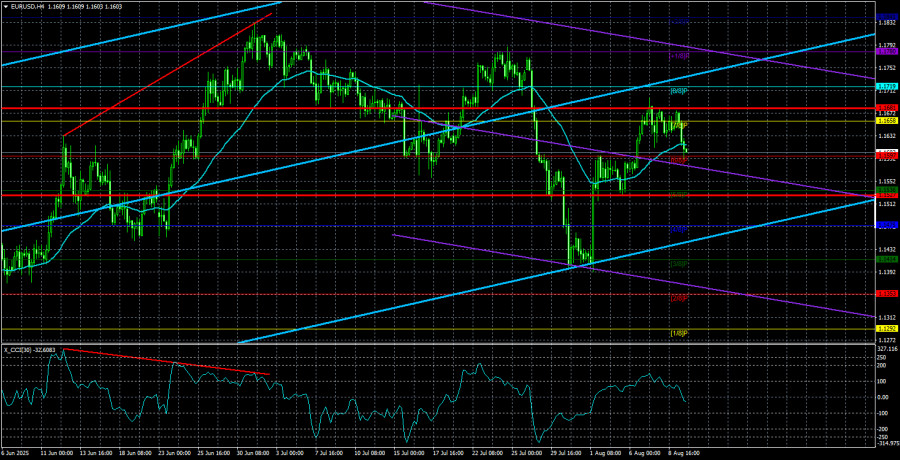

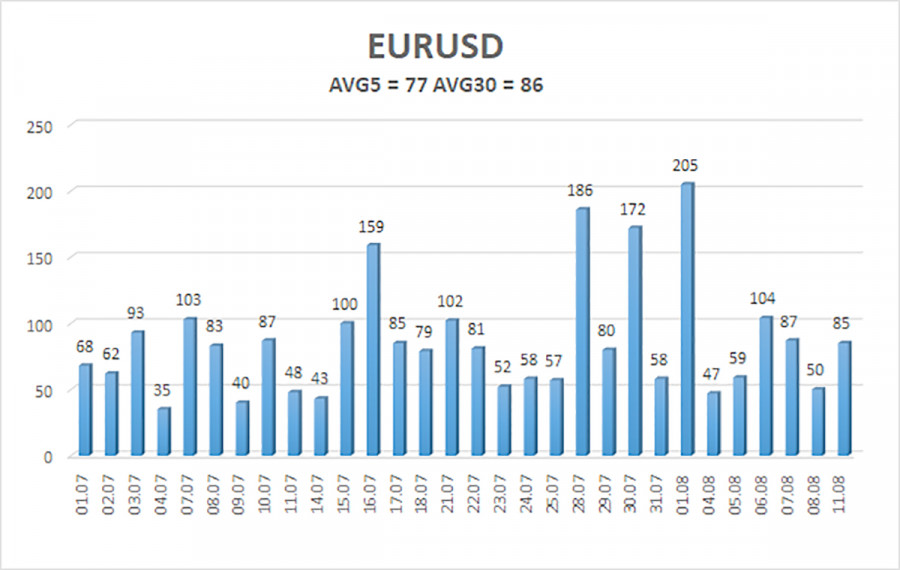

La volatilidad promedio del par EUR/USD en los últimos 5 días de negociación a 11 de agosto es de 77 puntos y se califica como "media". Esperamos un movimiento del par entre los niveles de 1,1527 y 1,1681 el martes. El canal lineal de regresión mayor está dirigido hacia arriba, lo que sigue indicando una tendencia alcista. El indicador CCI entró tres veces en la zona de sobreventa, lo que advirtió sobre la reanudación de la tendencia alcista.

Niveles de soporte más cercanos:

S1 – 1,1597

S2 – 1,1536

S3 – 1,1475

Niveles de resistencia más cercanos:

R1 – 1,1658

R2 – 1,1719

R3 – 1,1780

Recomendamos consultar otros artículos del autor:

Análisis del par GBP/USD. El 12 de agosto. Una inflación que ya no decide nada.

Recomendaciones para operar y análisis de las operaciones con el par EUR/USD el 12 de agosto.

Recomendaciones para operar y análisis de las operaciones con el par GBP/USD el 12 de agosto

Recomendaciones para operar:

El par EUR/USD puede reanudar la tendencia alcista. La política de Donald Trump sigue teniendo un fuerte impacto en la moneda estadounidense, y él no piensa "detenerse en lo logrado". El dólar subió todo lo que pudo, pero ahora parece que llega el momento para una nueva etapa de prolongada caída. Con el precio por debajo de la media móvil se pueden considerar los cortos pequeños con objetivos en 1,1536 y 1,1527. Por encima de la media móvil, las posiciones largas con objetivos en 1,1719 y 1,1780 siguen siendo relevantes en la continuación de la tendencia.

Explicaciones para las ilustraciones:

Los canales de regresión lineal ayudan a identificar la tendencia actual. Si ambos están orientados en la misma dirección, significa que la tendencia es fuerte.

La media móvil suavizada (20,0) determina la tendencia a corto plazo y la dirección en la que conviene operar.

Los niveles de Murray representan objetivos de movimiento y correcciones.

Los niveles de volatilidad (líneas rojas) muestran el canal de precios probable en el que el par se moverá durante el próximo día, según la volatilidad actual.

El indicador CCI, al entrar en la zona de sobreventa (por debajo de -250) o sobrecompra (por encima de +250), indica que se aproxima un giro en la tendencia.