The GBP/USD pair traded differently on Tuesday than the EUR/USD pair, even though both pairs have shown similar dynamics in recent days, weeks, and months. Therefore, the reasons for the decline of the British currency should have been sought within the UK. It is worth noting that there were no macroeconomic reports or significant events scheduled for Tuesday in the EU, the UK, or the U.S.. Thus, the search took a while and was not focused on the economy.

The cause of the new drop in the British pound was a statement from the "politician of the hour" – Rachel Reeves, the head of the UK Treasury. As mentioned earlier, Reeves has already triggered at least two significant declines in the British currency with her comments and actions. Initially, she broke down in tears in the UK Parliament amid criticism of her budget proposal for the next financial year. Then, Reeves commented several times on government bonds and the state of the UK economy. Later, she presented a failing budget proposal that was again subjected to harsh criticism. Thus, traders have formed a logical pattern – when the head of the Treasury speaks, it means they should prepare for selling the pound.

This time, Reeves subtly implied that the UK's exit from the EU was a mistake and that restoring trade and economic ties with the Alliance would greatly benefit Britain. Furthermore, according to Reeves, new agreements with the European Union that alleviate some restrictions are gaining domestic public support.

Overall, since the historic referendum in 2016 and following the official exit from the EU in 2020, numerous social surveys have been conducted among the British population to understand how attitudes toward Brexit have changed. Most of these surveys indicate that the British largely regret leaving the EU and would like to return to the Alliance at some point. It is noteworthy that as early as 2016, supporters of Brexit exceeded opponents by only 3%. Thus, almost half of the British population did not support the break from the EU even back in 2016, and their numbers have only grown over the years.

Now let's consider how the pound and, for comparison, the euro have behaved since 2016. The British pound has lost as much as 28% of its value against the U.S. dollar since 2016, and is currently trading 8% lower. Meanwhile, the euro has lost a maximum of 15% of its value since 2016, but is currently trading 3% higher. This indicates that Brexit has indeed negatively impacted the UK economy, and the benefits of leaving the EU have proven to be smaller than the losses.

Why has the British pound fallen if the UK seemingly wants to restore ties with the EU? Because all of this is just "flailing after the fight." If the UK ever decides to return to the EU, it will not happen anytime soon. Market participants have spent the last 5-6 years adapting to a new economic reality, and now suddenly the Treasury Secretary is almost openly stating that Brexit was a mistake... Investors do not like changes. They prefer stability.

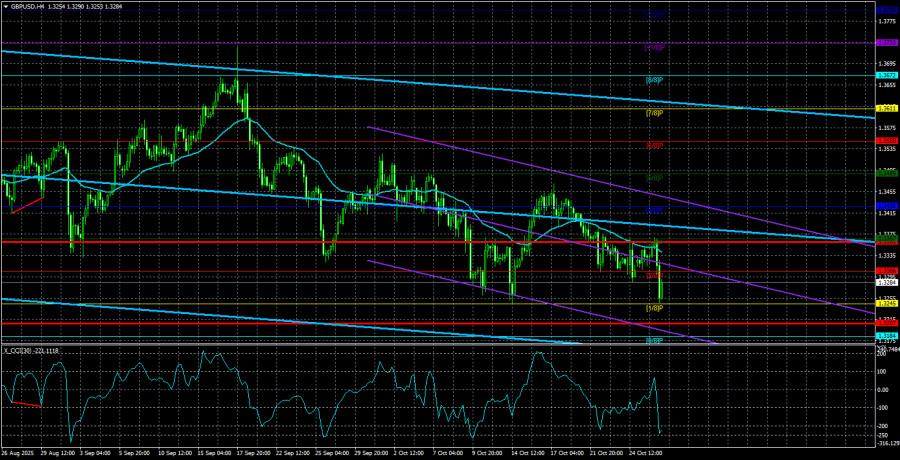

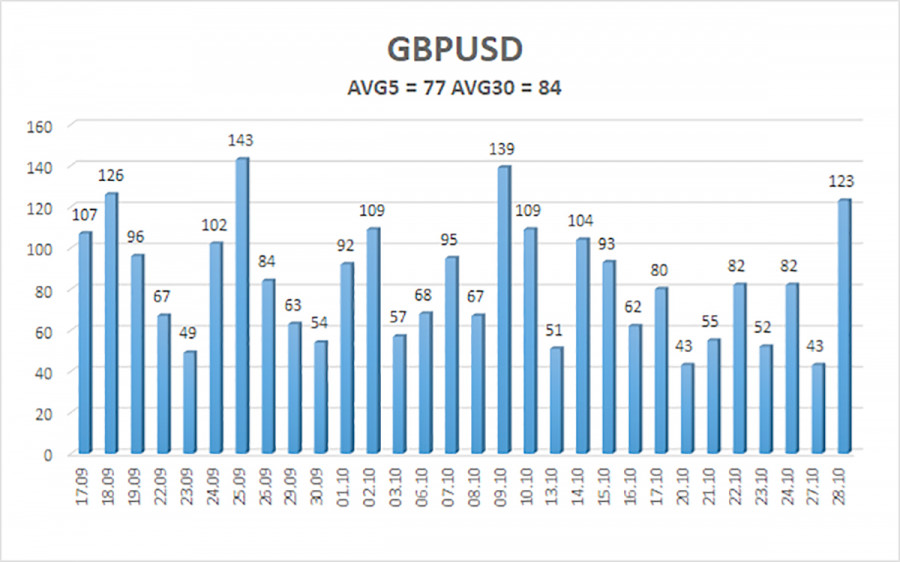

The average volatility of the GBP/USD pair over the last five trading days is 77 pips, which for the pound/dollar pair is considered "average." On Wednesday, October 29, we thus expect movement within the range limited by the levels 1.3207 and 1.3361. The upper linear regression channel points upward, indicating a clear upward trend. The CCI indicator has entered the oversold area three times and is now close to a fourth entry, warning of a resumption of the upward trend.

Nearest Support Levels:

- S1 – 1.3245

- S2 – 1.3184

- S3 – 1.3123

Nearest Resistance Levels:

- R1 – 1.3306

- R2 – 1.3367

- R3 – 1.3428

Trading Recommendations:

The GBP/USD pair is trying to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Therefore, long positions with targets of 1.3672 and 1.3733 remain much more relevant while the price is above the moving average. If the price is below the moving average line, small shorts can be considered with targets of 1.3245 and 1.3207 on purely technical grounds. From time to time, the American currency shows corrections, but for a trend-based strengthening, it requires real signs of the end of the trade war or other global positive factors.

Explanations for the Illustrations:

- Linear Regression Channels: Help determine the current trend. If both are directed in one direction, it indicates a strong trend.

- Moving Average Line (settings: 20.0, smoothed): Determines the short-term trend and trading direction.

- Murray Levels: Target levels for movements and corrections.

- Volatility Levels (red lines): Probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator: Its entry into the oversold area (below -250) or overbought area (above +250) indicates an impending trend reversal in the opposite direction.