The EUR/USD currency pair traded more calmly on Wednesday than the previous day. However, the previous day's significant movement also began only closer to the evening. It was not related to the macroeconomic background, as U.S. reports released in the second half of the day were disappointing and came in even worse than the already pessimistic forecasts. Therefore, by all accounts, the U.S. dollar should have fallen again. But instead, it rose—something that has been happening rarely for the dollar lately, even when there are valid reasons for a decline.

We believe the dollar's rise was solely due to the possible escalation of the conflict between Israel and Iran, in which Trump now openly wants to get involved. In truth, the story of Trump as a peacemaker sounds like a contradiction in terms. Before the elections, during the campaign, and immediately after the inauguration, Trump repeatedly claimed that the war between Ukraine and Russia would never have started if he had been president. Apparently, Americans believed the Republican and his first term in office taught no one any lessons. As soon as Trump officially became president of the United States again, he declared he would end the conflict in Eastern Europe within 24 hours. Yet now, in the fifth month of his presidency, he seems to have lost interest in the Ukraine–Russia war altogether.

Instead, under Trump, conflict first broke out between India and Pakistan and then intensified between Israel and Iran. Let's not forget that it's still just the fifth month of his presidency. The U.S. has long demanded that Iran abandon nuclear weapons and all forms of nuclear development. However, Iran refuses to comply with this ultimatum and doesn't understand why the U.S. is trying to impose its will.

The global concern is understandable. The more countries possess nuclear weapons, the faster the entire world could collapse if a third world war were to begin. There would be no winners in such a war—this is already a certainty. Sadly, in 2025, we are forced to seriously discuss the possibility of a third world war and nuclear strikes. There was a time when the COVID-19 pandemic seemed like the worst thing that could happen. That no longer feels like the case.

Iran's stance can be understood when considering the broader context. For example, why is it acceptable for the U.S. to possess nuclear weapons while Iran is prohibited from having them? Iranian leaders claim that any nuclear warheads they might possess would be for defensive purposes only, but the true intentions and potential use of such weapons remain uncertain. In general, the nature of the conflict is highly complex, and neither side is willing to back down.

Trump has already hinted several times that a devastating strike could be launched against Iran within the next 24 to 48 hours. Naturally, only military and nuclear facilities would be targeted. Trump has urged all civilians to leave Tehran as soon as possible. Iran's Supreme Leader Ali Khamenei has declared that Iran will not surrender and that any American military strike on the country would have severe consequences. Khamenei also stated that Iran would not accept peace forced upon it. As such, new missile attacks in the Middle East may be expected in the next couple of days. Most likely, the dollar has once again appreciated purely on geopolitical grounds.

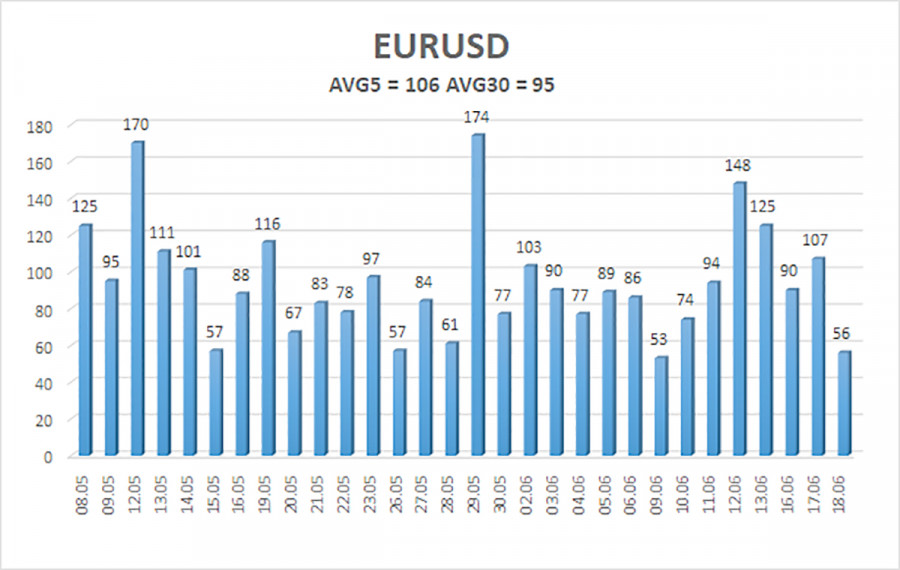

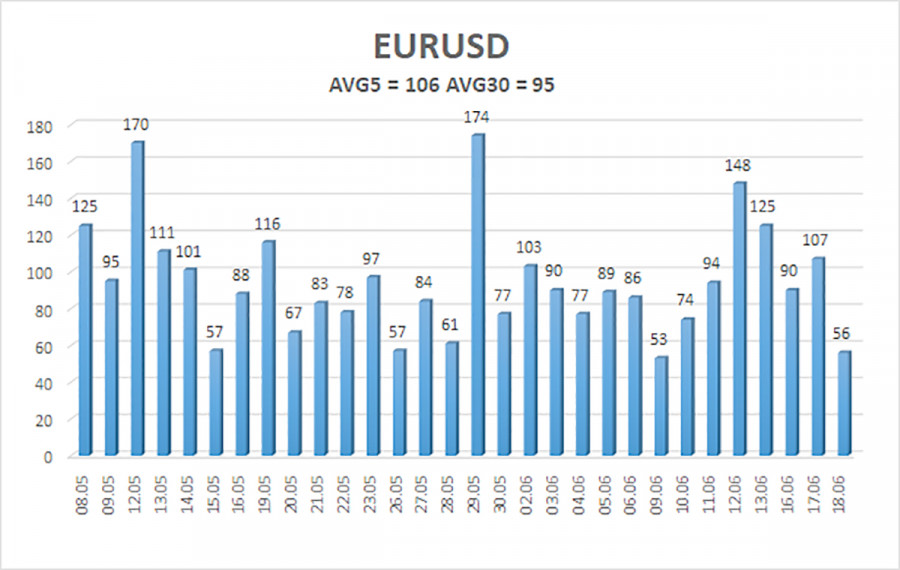

The average volatility of the EUR/USD pair over the last five trading days, as of June 19, stands at 106 pips and is classified as "moderate." We expect the pair to move between the levels of 1.1406 and 1.1619 on Thursday. The long-term regression channel remains upward-facing, which continues to indicate a bullish trend. The CCI indicator recently entered overbought territory, which only triggered a modest downward correction.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues its upward trend. The U.S. dollar remains heavily influenced by Trump's foreign and domestic policies. Additionally, the market interprets many economic data points in a way that is unfavorable to the dollar or ignores them altogether. We observe a complete unwillingness on the part of the market to buy the dollar under any circumstances. If the price falls below the moving average, short positions targeting 1.1406 and 1.1353 remain relevant, although a sharp decline in the pair is unlikely under current conditions. If the price remains above the moving average, long positions targeting 1.1597 and 1.1619 are justified in line with the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.