Analysis of Friday's Trades

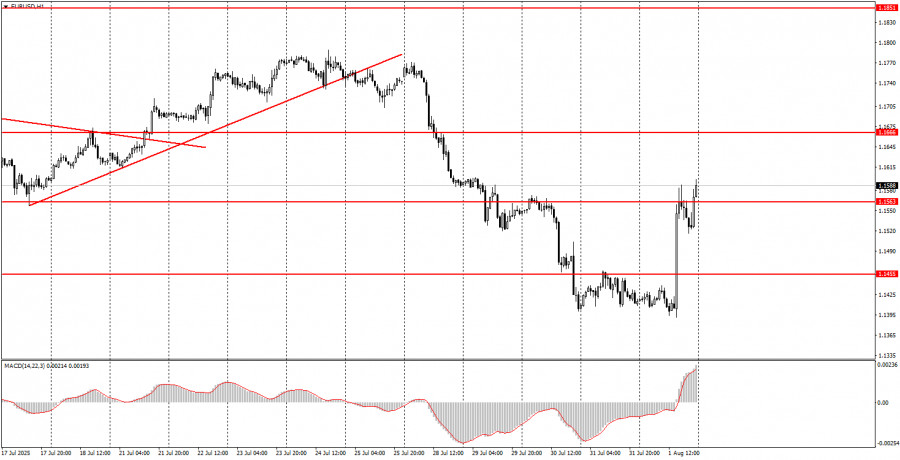

1H Chart of EUR/USD

The EUR/USD currency pair showed strong growth on Friday, which was completely justified—just like all market movements last week. Let us recall that for most of the week (four days), the dollar sat confidently on the pedestal, as nearly all news favored it. This included strong U.S. GDP in Q2, Donald Trump's outrageous but rather lucrative trade agreements, and Jerome Powell's hawkish tone at the Federal Reserve meeting.

This entire "house of cards" collapsed on Friday when the Nonfarm Payrolls report was released, and Trump announced tariff hikes for 60 countries. It turned out that the economic growth in the U.S. in the second quarter had no real support. Inflation is rising, and the labor market is shrinking. In other words, the U.S. economy is not growing due to job creation or increased business investment—it is growing artificially, driven by tariffs and constant distortions in import and export balances.

Thus, the market finally grasped a simple idea that we had previously pointed out: Trump's policy looks good on paper, but reality is far less optimistic.

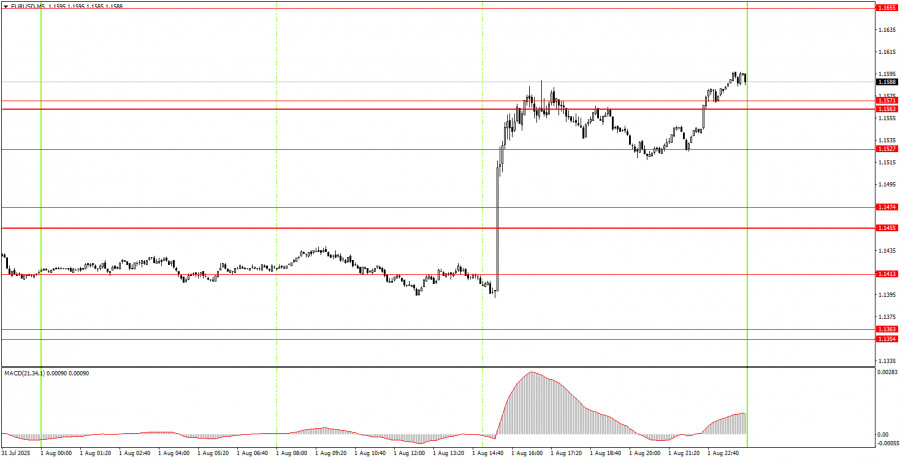

5M Chart of EUR/USD

On the 5-minute timeframe on Friday, many signals were formed, but we didn't even bother to mark them. Before the release of the U.S. data, price movement was quite calm, with almost no trading signals. Entering the market before the Nonfarm Payrolls release made no sense. After the publication, chaotic movements began, and the market paid no attention to technical levels.

Trading Strategy for Monday:

On the hourly timeframe, the EUR/USD pair has every chance to resume the uptrend that has been forming since the beginning of this year. The U.S. dollar's "house of cards" collapsed. We had previously warned that the American currency lacked long-term reasons to rise and had questioned the "optimism" surrounding Trump's policy and its early results. Friday confirmed that we were right.

On Monday, the EUR/USD pair could move in either direction, as the market will continue to "digest" Friday's events. In addition to the disappointing labor market data, we should also note a new tariff package from the generous American president—along with a new batch of threats. We believe the dollar will continue to fall.

On the 5-minute timeframe, consider the following levels for Monday: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.

There are no major reports or events scheduled in either the Eurozone or the U.S. on Monday, but since Trump has "awakened from hibernation," we should expect some news.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.