Analysis of Trades and Trading Tips for the British Pound

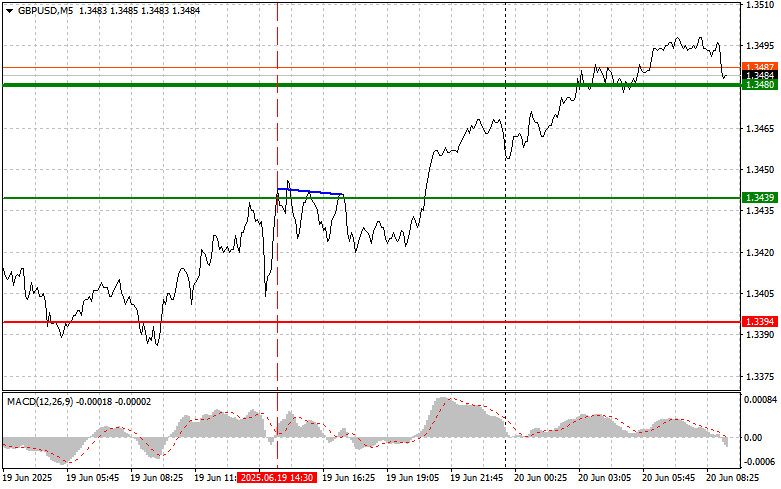

The price test at 1.3439 occurred when the MACD indicator had just begun to move upward from the zero mark, which confirmed a valid entry point for buying the pound. However, the pair never developed a significant upward move.

The Bank of England maintained the interest rate at 4.25%. However, policymakers expressed concern about a downturn in the UK labor market. The Bank's decision was expected and reflects its aim to strike a balance between curbing inflation and avoiding risks of an economic downturn. Keeping the rate steady will allow time to assess the effect of previous rate reductions and avoid putting excessive strain on an economy already under multiple negative influences. The central bank is especially concerned about the labor market situation. A decline in job vacancies and a rise in unemployment could foreshadow a deeper economic crisis. Weak economic growth also poses a serious challenge. Geopolitical tensions add further uncertainty and worsen the economic outlook. Sanctions, trade wars, and political instability negatively impact the global economy and pressure the UK.

Today, figures are expected to be released regarding the change in the UK retail sales volume, which includes fuel costs and public sector net borrowing. This data will serve as important indicators of the current state of the UK economy, especially given the ongoing challenges with inflation and the potential for recession. Fuel-adjusted retail sales volume reflects consumer activity, a key economic growth driver. A drop in this figure could indicate reduced consumer purchasing power, driven by rising prices and future uncertainty. Meanwhile, net public sector borrowing will show the extent to which the government needs to fund its expenditures through debt. A high level of borrowing could imply increased government spending to support the economy but may also raise concerns about the long-term sustainability of public finances.

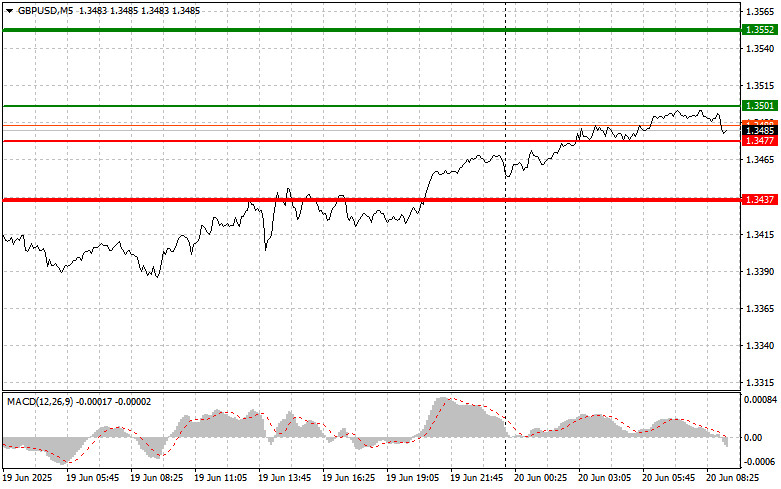

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the pound today around the 1.3501 entry point (green line on the chart), targeting a rise toward 1.3552 (thicker green line on the chart). At 1.3552, I intend to exit the buy trade and open a sell position in the opposite direction (expecting a move of 30–35 pips from the level). Bullish expectations for the pound today depend on strong data.

Important: Before buying, ensure the MACD indicator is above zero and just starting to rise.

Scenario #2: I also plan to buy the pound if the price tests 1.3477 twice consecutively while the MACD is in the oversold zone. This would limit the pair's downside potential and trigger an upward market reversal. A rise toward 1.3501 and 1.3552 may follow.

Sell Scenario

Scenario #1: I plan to sell the pound after it breaks below 1.3477 (red line on the chart), which could lead to a swift decline. The main target for sellers will be 1.3437, where I intend to exit the sell position and immediately open a buy in the opposite direction (expecting a 20–25 pip rebound from the level). Selling is appropriate after weak data.

Important: Before selling, ensure the MACD indicator is below zero and beginning to decline.

Scenario #2: I plan to sell the pound today if the price tests 1.3501 twice a row while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a downward reversal. A decline toward 1.3477 and 1.3437 may follow.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.