S&P 500 futures and European indices surged, while the Nikkei dropped. A surprise result of the US employment report prompted markets to price in additional rate cuts. Investors await earnings reports from Disney, McDonald's, and Caterpillar. The dollar remained unchanged following Friday's sharp reversal. Oil is falling amid increased output from OPEC+.

Earnings reports breathe life into Wall Street

US companies continue to impress with strong financial results, restoring optimism in the markets. Particularly noteworthy are players actively deploying artificial intelligence technologies. Their success has become a key factor supporting stock market momentum.

Short-term instability, but encouraging outlook

While experts forecast near-term volatility, the long-term outlook remains positive. Business fundamentals, especially in the AI sector, indicate steady growth ahead.

Record highs within reach

As of the data release, nearly 300 companies in the S&P 500 had reported Q2 earnings, showing a 9.8% year-over-year increase, far exceeding earlier expectations of 5.8%. Shares of many companies are nearing all-time highs, bolstering investor confidence despite subdued demand and ongoing trade risks.

Investors eye reports from market giants

This week, all eyes are on quarterly results from Disney, McDonald's, and Caterpillar. These reports will offer valuable insight into the health of the US economy and may provide the final push for the Dow Jones to surpass its December peak.

AI becomes driver of future growth

Analysts highlight that companies investing in artificial intelligence are delivering the most impressive results. This strengthens the belief that AI could become a powerful growth engine shaping the future economy and unlocking new revenue streams.

Challenging start to year for markets

After several quarters of steady growth, global equity markets encountered unexpected turbulence. The catalyst was the rapid emergence of Chinese AI-focused startup DeepSeek. Its arrival on the global stage raised investor concerns that intensifying competition might erode the dominance of tech giants like Nvidia.

August may be test of resilience

Although the S&P 500 rose by 2.2 percent in July, experts warn that the market is entering two traditionally volatile months, August and September. According to analyst Hogan, historically, this period sees a spike in market volatility, often peaking by October.

Market opens August with sharp losses

Friday's trading session began with broad-based selling. The catalysts were new US trade restrictions and disappointing earnings from Amazon. A weakening labor market further fueled concerns, dampening investor appetite for risk assets.

Asian exchanges offer markets breath of fresh air

By Monday, conditions began to stabilize, supported by encouraging signals from Asia. Investors were reassured by the possibility of rate cuts, which helped ease fears of a US economic slowdown. Still, overall confidence in Washington's economic policy remains uncertain.

Investors seek entry points once again

The "buy-the-dip" approach regained popularity. This contributed to a rebound in US and European equity futures and allowed the dollar to claw back some ground after Friday's losses, which were triggered by weak employment data.

Rate cut expectations from Fed remain elevated

US Treasuries saw some profit-taking after their recent rally. Nevertheless, the futures market continues to price in a roughly 85% probability of a Federal Reserve rate cut in September. Moreover, traders are factoring in the potential for 100 basis points or more in monetary easing over the next year.

Hopes for rate cuts grow amid weak jobs data

The latest employment figures delivered a major blow to investors. Revised data showed the average monthly job gain over the past three months fell to just 35,000, a sharp drop from over 230,000 earlier this year. The only silver lining was the rising likelihood of monetary policy easing.

Trump's reaction fuels fire

The dismissal of the head of the Bureau of Labor Statistics by President Donald Trump has sparked a wave of criticism. Against the backdrop of unstable macroeconomic indicators, this move cast doubt on the reliability of official data regarding the US economy.

Appointments at Fed raise concerns

Additional anxiety was caused by reports of Trump's intention to appoint a new member to the Federal Reserve Board of Governors ahead of schedule. Market participants fear that the candidate could be politically dependent, which may compromise the independence of the key financial institution. Although Trump acknowledged that Jerome Powell is likely to remain Fed Chair until the end of his term, this did not fully ease concerns.

Bonds signal policy shift

Financial markets have already begun pricing in future changes. The yield on two-year Treasury notes fell by nearly 25 basis points on Friday, the steepest one-day drop since August last year. This reinforced expectations of a rate cut.

Stock markets recover as yields decline

Against the backdrop of falling yields, investors began returning to equities. Futures on the S&P 500 and Nasdaq rose by 0.4 percent each. European indices also moved higher: the EUROSTOXX 50 climbed 0.6 percent, the FTSE added 0.5 percent, and the DAX advanced 0.4 percent.

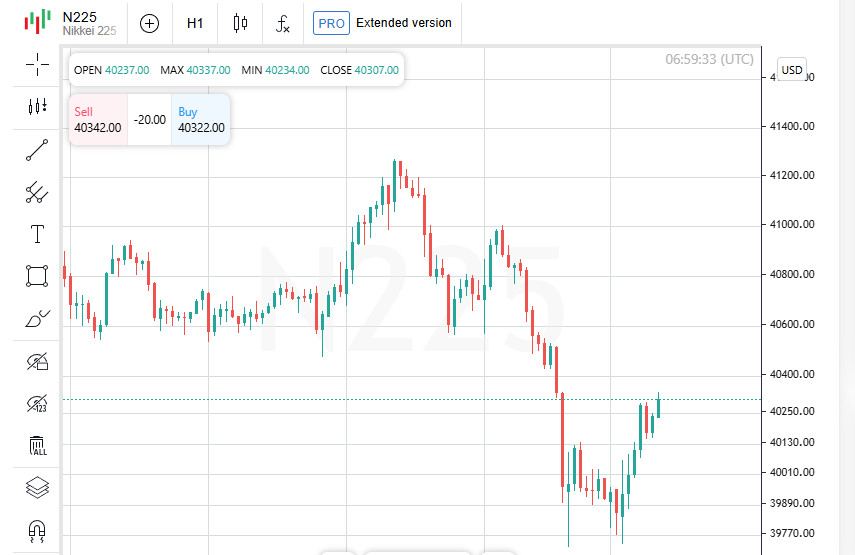

Asian markets in green, Japan under pressure

The MSCI Asia-Pacific Index excluding Japan rose 0.7 percent, driven by a 1.1 percent gain in South Korea's stocks. Meanwhile, Japan's Nikkei dropped 1.4 percent due to yen appreciation. Shares of China's largest companies remained unchanged.

Strong results boost investor sentiment

The US stock market received a boost from optimistic earnings season results. Of the approximately 500 S&P companies, two-thirds have already reported, with 63 percent exceeding analysts' expectations. Overall earnings growth reached 9.8 percent, marking a significant improvement from the 5.8 percent forecast at the beginning of July.

Big names in spotlight — from Disney to Pharma

This week saw financial reports from giants such as Disney, McDonald's, and Caterpillar, as well as several leading pharmaceutical companies. These reports allowed investors to better assess the state of business across key sectors of the economy.

Weak labor market pressures dollar

Disappointing US labor market data pressured the dollar, undermining its recent dominant position. The currency rebounded slightly to 147.79 yen after falling 2.3 percent on Friday. The euro remained stable at 1.1574 dollars following a 1.5 percent surge late last week.

Sterling awaits Bank of England decision

The US dollar index pulled back to 98.801 from last week's high of 100.250. The British pound held at 1.3281 dollars as investors remain nearly certain, with an 87 percent probability that the Bank of England will cut its key rate on Thursday. The regulator remains divided in its outlook, but the market still expects at least two rounds of easing before mid-next year.

Oil slips, gold stabilizes

In commodities, gold held steady at 3,357 dollars per ounce, after a modest correction from Friday's more than 2 percent rally. Oil continued to decline: Brent fell by 0.2 percent to 69.52 dollars per barrel, and US WTI slipped by 0.1 percent to 67.24 dollars. The reason was the OPEC+ decision to raise production in September, effectively canceling the output cuts agreed upon a year ago.